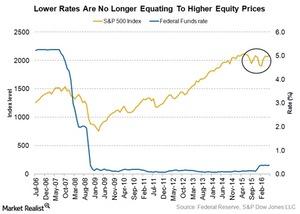

Lower Rates Aren’t Equating to Higher Equity Prices

Bill Gross provided his view on lower rates no longer resulting in credit creation in the economy. They have also lost their efficacy in raising equity prices.

Nov. 22 2019, Updated 7:10 a.m. ET

Lower rates aren’t inflating asset prices

Bill Gross provided his view on lower rates no longer resulting in credit creation in the economy (IWM) (QQQ) (SPY). Another key point is that they have also lost their efficacy in raising equity prices too. With earnings growth no longer supporting the artificially inflated asset prices, we’re currently seeing markets looking for a cushion.

Market had risen on the back of M&A and buybacks

Over the years, low interest rates have led to an earnings mirage. Asset prices have been soaring on the back of lower interest rates. We saw the availability of cheap credit leading to a buyback and M&A (mergers and acquisitions) spree in the US.

Decelerating profit cycle and declining ROEs

However, it has come to a point where markets are reacting to this decelerating profit cycle, as Richard Bernstein, CEO of Richard Bernstein Advisors, also noted. Investors who had been viewing the rise in the S&P 500 (SPXS) (SPXU) as a signal of rising corporate profitability—without considering their relative meaning—have now been faced with reality. Corporate profitability is plunging. The S&P 500’s ROE (return on equity) is declining quickly as well as the return on their investment in these firms.

With low returns and investors’ confidence shaken, you can’t expect lower rates to spur the equity markets. The preferred monetary policy tool of lowering rates definitely seems to have lost its potency in the current economic environment.

With central banks seemingly left with no recourse on the monetary side, we might see fiscal attempts gearing up.