JetBlue Airways: What Are Analysts’ Recommendations?

JetBlue Airways (JBLU) is expected to release its 2Q16 earnings on July 26. According to an analyst consensus, JBLU is expected to earn $0.49 in 2Q16, compared to earnings per share of $0.44 in 2Q15.

Nov. 20 2020, Updated 11:19 a.m. ET

Earnings estimates

JetBlue Airways (JBLU) is expected to release its second quarter earnings on July 26, 2016. The company is expected to earn $0.49 in 2Q16 according to an analyst consensus surveyed by Bloomberg, compared to EPS of $0.44 in 2Q15.

Analyst recommendations

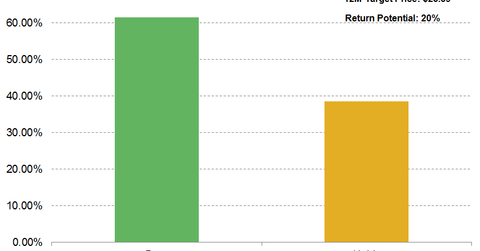

Out of the 13 analysts tracking JBLU, 61.5% of the analysts (eight analysts) have a “buy” rating on the stock, 38.5% (five analysts) have a “hold,” rating, and none of the analysts have a “sell” rating.

With the exception of Eva Dimensions, all analysts have maintained their rating on the stock after 1Q16’s results, which indicates bullishness for the company’s stock.

Target prices

The consensus target price for JBLU is $23.59, which indicates a return potential of 20% from the current market price. JetBlue Airways received some mixed ratings ahead of its second quarter earnings release. Let’s look at some of the latest analyst views for the company:

- David E. Coleman from Argus Research has the highest price target for JetBlue Airways at $26.00. Argus Research maintains a “buy” rating on the stock.

- Duane Pfennigwerth from Evercore ISI follows closely with a $25 stock price and has also maintained its “buy” rating on JetBlue stock.

- Julie Yates from Credit Suisse reaffirmed the company’s stock to its rating of “neutral” with its second-lowest price target of $20.

- Rajeev Lalwani from Morgan Stanley has the lowest price target of $18.

Investors can read our pre-earnings analysis reports of Alaska Air Group (ALK), Spirit Airlines (SAVE), American Airlines (AAL), and Southwest Airlines (LUV). The Guggenheim S&P MidCap 400 Pure Growth ETF (RFG) holds 0.84% of its portfolio in JBLU.