Why Do Housing Starts Remain Muted?

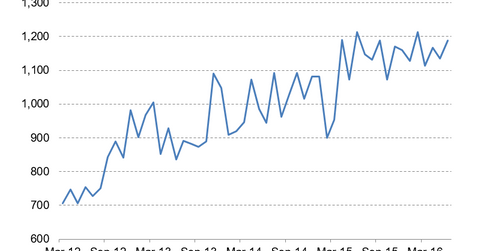

Housing starts and building permits came in around 1.2 million—towards the top end of a narrow range over the past year.

July 25 2016, Updated 9:08 a.m. ET

Week in review

Last week, stocks rallied and bond yields rose as investors became more sanguine about the consequences of the Brexit vote. Stocks were buoyant and bonds slipped. The federal funds futures aggressively took up the estimates for a rate hike this year from 20% to closer to 45%. The fallout from the Brexit vote has been much more muted than people predicted. This made markets more confident that the Fed can hike interest rates one more time this year.

Housing starts and building permits came in around 1.2 million—towards the top end of a narrow range over the past year.

Implications for mortgage REITs

Last week, bond yields rose by 2 basis points to 1.6% as global bonds sold off. Stocks gained on the risk-on trade, but markets still expect the Fed to do nothing next week. This sentiment is generally good news for MBS (mortgage-backed securities) investors.

That being said, recent volatility in the bond market isn’t necessarily good news for mortgage REITs. They hedge the interest rate risk of their portfolios—readjusting their hedges works against them. The perfect scenario for them is a Treasury market that moves very little and allows them a good yield pickup. For REITs, the good news is that the Fed is pretty much on hold.

A more dovish Fed is generally good news for agency REITs such as Annaly Capital Management (NLY) and American Capital Agency (AGNC). It will also help mortgage originators like PennyMac Mortgage Investment Trust (PMT) and Redwood Trust (RWT).

Investors interested in making directional bets on interest rates can look at the iShares 20+ Year Treasury Bond ETF (TLT).

Implications for homebuilders

Homebuilders such as PulteGroup (PHM) and CalAtlantic Group (CAA) will benefit from the stronger-than-expected economic data. In the long term, builders will have an opportunity to meet pent-up demand when the economy finally starts hitting on all cylinders. Homebuilders still lack the confidence to really push out the volume, as evidenced by the housing starts numbers—they’re well below pre-bubble historical levels of 1.5 million units a year. Meanwhile, pent-up demand continues to build. You can invest in homebuilders through the SPDR S&P Homebuilders ETF (XHB).

In the next part of this series, we’ll look at bond yields last week.