GlaxoSmithKline’s Revenue Trend

GlaxoSmithKline reported a rise of 23% in its 3Q16 revenue. The company met Wall Street analysts’ consensus 3Q16 estimates for revenue and earnings per share.

Dec. 29 2016, Updated 5:05 p.m. ET

GlaxoSmithKline’s revenue

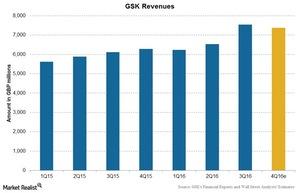

GlaxoSmithKline (GSK) reported a rise of 23% in its 3Q16 revenue to 7.5 billion British pounds. The company met Wall Street analysts’ consensus 3Q16 estimates for revenue and earnings per share (or EPS), reporting EPS of 0.32 pounds and revenue of 7.5 billion pounds in the quarter.

Further to this, analysts estimate a rise of 17.3% in the company’s 4Q16 revenue.

The above chart shows GSK’s revenue trend along with analysts’ estimates. There are various factors affecting these revenues. We’ll discuss these factors later in the series.

3Q16 performance

GlaxoSmithKline’s top line rose 23% to ~7.5 billion pounds in 3Q16, driven by an operational rise of 8% and a favorable currency impact of 15%. This rise in revenue was mainly driven by the new pharmaceutical and vaccine products the company added to its portfolio. The positive impact of foreign exchange was due to the weakening of the pound against all major world currencies.

Geographically, US markets contributed nearly 37.9% of GSK’s total revenue, at 2.9 billion pounds, in 3Q16, a rise of 13% at constant exchange rates compared to 3Q15. European markets contributed nearly 25.9% to GSK’s total revenue, at 2.0 billion pounds, in the quarter, a rise of 6% at constant exchange rates compared to 3Q15.

The contribution from international markets was nearly 36.2% of total revenues at 2.7 billion in 3Q16, a 3% rise compared to 3Q15. The rise in GSK’s revenues across all geographies was due to the strong performance of its new pharmaceutical products, including HIV treatments and vaccines products.

In order to divest risk, investors can consider ETFs such as the iShares S&P Global Healthcare ETF (IXJ), which holds 2.5% of its total assets in GlaxoSmithKline, ~8.1% of its assets in Johnson & Johnson (JNJ), 3.9% in Merck & Co. (MRK), and 2.9% in Amgen (AMGN).