Can Freeport-McMoRan’s 2Q16 Earnings Justify Its Rally?

Freeport-McMoRan (FCX) is expected to release its 2Q16 earnings on July 26. In this series, we’ll explore what Wall Street analysts expect from FCX’s 2Q16 earnings.

Dec. 4 2020, Updated 10:53 a.m. ET

Freeport’s 2Q16 earnings

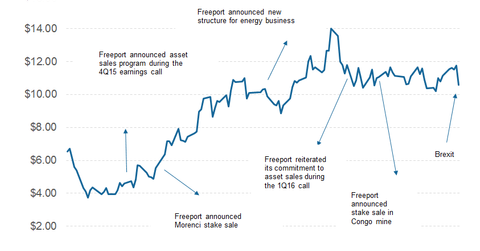

Freeport-McMoRan (FCX) is expected to release its 2Q16 earnings on July 26. Freeport’s 2Q16 earnings will come at a time when the company has proved several analysts wrong in its fight for survival, gaining 94% year-to-date after losing 70% of its market capitalization in 2015.

Freeport-McMoRan bears lost their shirts as the stock kept skyrocketing. Bears could only take consolation in January and May, when Freeport saw negative price action. Even the Brexit vote could only act as a small speed bump for the company, whose stock recouped most of the losses in the next few trading sessions.

Materials sector

Along with the improved “risk-on” sentiment, asset sales have been a key driver of Freeport’s 2016 performance. You can explore this more in Understanding the Strategic Importance of Freeport’s Asset Sales.

Other leveraged copper miners like Glencore (GLNCY) and Teck Resources (TCK) have also seen a spectacular rally in 2016. Southern Copper (SCCO) has traded flat this year.

The 2Q16 earnings season started on a strong note for material companies (XLB). Alcoa, which is the leading US-based aluminum producer, positively surprised investors with its 2Q16 earnings. While Alcoa’s 2Q16 revenues were more or less in line with consensus estimates, it managed to beat consensus earnings estimates.

Series overview

In this series, we’ll explore what Wall Street analysts expect from Freeport’s 2Q16 earnings. Freeport’s 2Q16 earnings call will be an opportunity for the company’s management to justify the rally in its stock price with earnings and 2016 guidance.