Bill Gross: Possibility of Deglobalization in the Economy

Gross warned about deglobalization in the global economy. Trade between nations, exacerbating immigration issues, and stagnant economic growth formed his belief.

Nov. 22 2019, Updated 7:10 a.m. ET

Bill Gross is highly critical of the Taylor rule and the Phillips curve

Bill Gross remains critical of Fed governors and presidents. He started his July 2016 investment outlook criticizing the Fed’s adherence to the Taylor rule and the Phillips curve as guides to monetary policy decision-making.

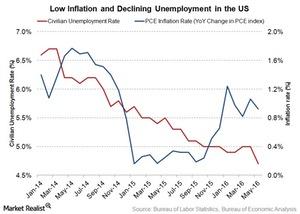

According to Gross, the Taylor rule is a backward-looking model used to determine short-term interest rates in an economy (IJH) (QQQ) (IWM). It’s highly sensitive to deviations in the output gap and to inflation from expected numbers. This rule also doesn’t take into account long-term economic prospects. The Phillips curve suggests a trade-off between inflation and employment. So, to have low inflation, you will have more unemployment and to have low unemployment, you will have high inflation.

Janet Yellen wouldn’t recognize the analogy!

Gross draws out an analogy between the current economy and a game of Monopoly (as we discussed earlier in this series) to highlight the redundancy of these models. Today’s highly levered world needs credit creation and credit velocity to stir economic growth. Gross sees Monopoly as a good functional model for the current financial system. At the same time, he’s pretty sure that Janet Yellen wouldn’t recognize any of it.

Possibility of deglobalization in the economy

In light of the above, Gross also took the opportunity to warn investors about the possibility of deglobalization in the global (VXUS) (VT) economy. He counts reducing trade between nations, exacerbating immigration issues, and stagnant economic growth as the basis of his belief.

Let’s look at what investment advice Bill Gross had for his followers in his July 2016 outlook.