What Do Analysts Recommend for Valero after 2Q16 Earnings?

Nine out of ten companies surveyed rated Valero (VLO) a “buy,” “overweight,” or “outperform.”

Aug. 1 2016, Updated 11:06 a.m. ET

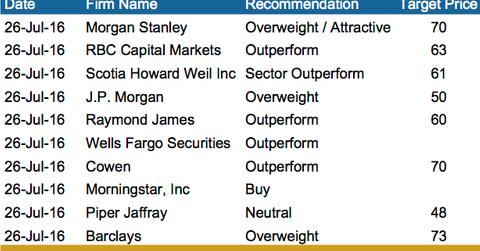

Analyst ratings for Valero

Nine out of ten companies surveyed rated Valero (VLO) a “buy,” “overweight,” or “outperform.” The highest and lowest 12-month price targets on VLO stand at $73 and $48, indicating a 38% rise and 9% fall from current levels, respectively. None of the analysts surveyed gave VLO a “sell” rating. The average target price of $62 on VLO implies a 17% gain.