The Word on the Street: What Analysts Are Saying about Truckload Carriers

Swift Transportation has a consensus rating of 4.36 or “strong buy” among truckload carriers. Out of 22 analysts, 15 gave it a “buy” recommendation.

June 28 2016, Updated 9:07 a.m. ET

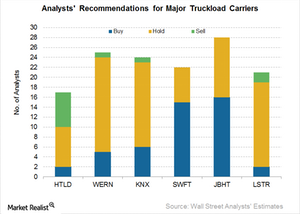

Analyst recommendations

For these Wall Street analyst recommendations, the rating scale ranges from one to five, with one meaning “strong sell” and five meaning “strong buy.”

Heartland Express (HTLD), for example, has an analyst consensus rating of 2.41, which means “hold.” Of the 17 analyst recommendations, two gave HTLD a “buy,” eight gave it a “hold,” and seven analysts gave it a “sell.” HTLD’s average 12-month price target is $17.8, as compared to its market price of $17.8 on June 17, 2016. This implies a zero return.

Werner Enterprises and Knight Transportation

Werner Enterprises (WERN) has a consensus rating of 3.32 or “hold.” Of the 25 analysts covering the stock, five analysts gave it a “buy.” WERN’s average 12-month price target is $28.4, as compared to its price of $24.4 on June 17. This translates into a potential return of 16.7%.

By comparison, Knight Transportation (KNX) has a consensus rating of 3.42 or “hold.” Of the 24 analysts who gave recommendations, six gave it a “buy” and seventeen gave it a “hold.” Only one analyst gave it a “sell.” KNX’s average 12-month price target is $27.5, as compared to its price of $26.9 on June 17. This translates into an implied return of 2.4%.

Swift Transportation and J.B. Hunt

Swift Transportation (SWFT) has a consensus rating of 4.36 or a “strong buy.” Of the 22 analysts who gave recommendations, 15 analysts gave it a “buy,” seven gave it a “hold,” and no analysts gave it a “sell.” The stock’s average 12-month price target is $21.4, as compared to its market price of $16.8 on June 17. This implies a potential return of 27.6%.

By comparison, J.B. Hunt Transport Services (JBHT) has a consensus rating of 4.11 or “buy.” Of the 28 analysts covering the stock, 16 analysts gave it a “buy,” while all remaining analysts have “holds.” JBHT’s average 12-month price target is $91.9, as compared to its price of $79.8 on June 17. This translates into an implied return of 15.1%.

Landstar System

Landstar System (LSTR) has a consensus rating of 3 or “hold.” Of the 21 analysts tracking the stock, two gave it a “buy,” 17 gave it a “hold,” and two gave it a “sell.” LSTR’s average 12-month price target is $66.1, as compared to its market price of $65.8 on June 17, 2016. This suggests a potential return of less than 1%.

Notably, major US airlines (DAL) and railroads are included in the portfolio holdings of the iShares Global Industrials ETF (EXI). EXI holds 1.2% and 2.1% in global express delivery companies FedEx (FDX) and United Parcel Service (UPS), respectively.

In the next and final part, we’ll examine the valuations of these truckload carriers.