Werner Enterprises Inc

Latest Werner Enterprises Inc News and Updates

Will Rise in Crude Oil Benefit US Truckload Carriers in 2018?

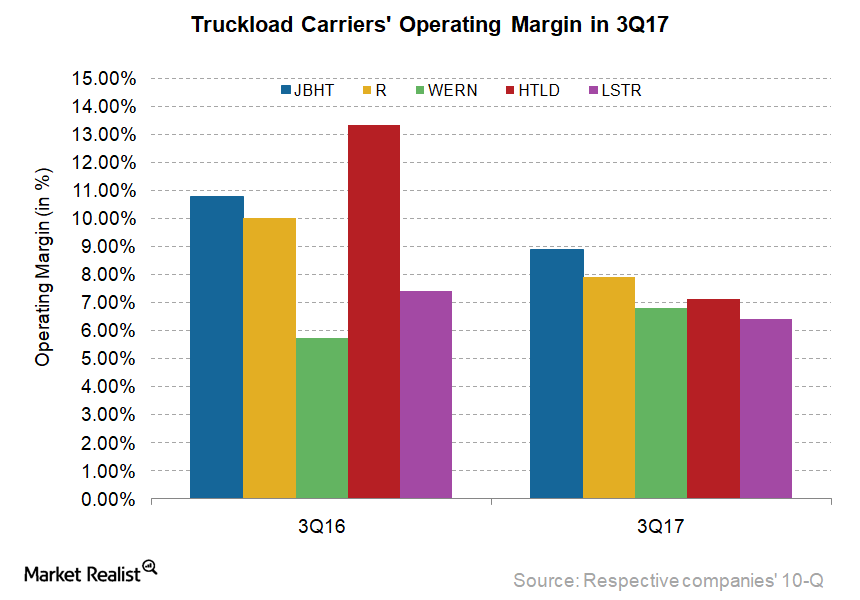

The average US on-highway diesel prices in 3Q17 have risen 20% compared to the same quarter last year.

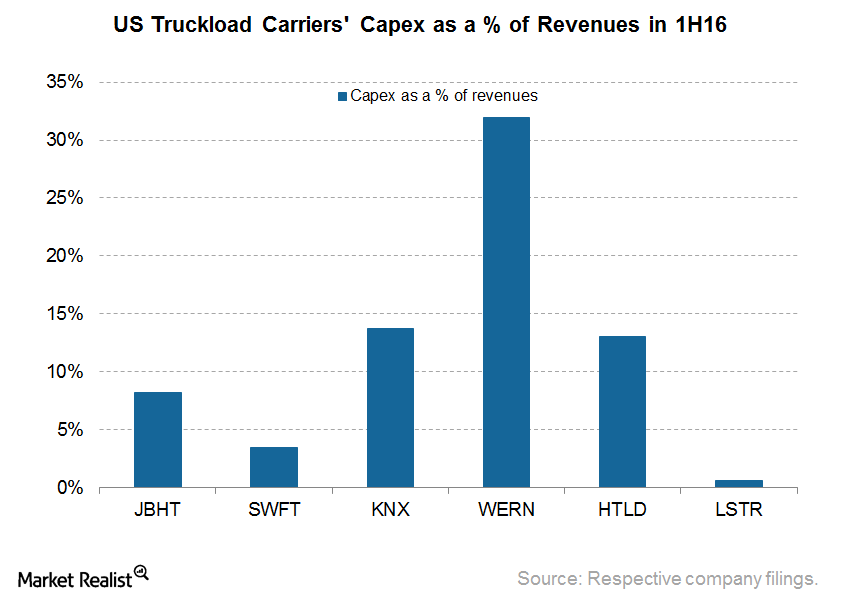

This Truckload Carrier’s Capital Expenditure Bucks the Trend

In the current weak freight regime, the extent of capital expenditure throws light on the growth prospects of these trucking carriers.

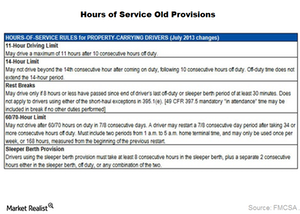

Understanding the Impact of Hours-of-Service Rules on Truckload Carriers

In July 2013, the FMCSA of the US Department of Transportation extended safety regulations regarding truckload drivers’ hours of service.

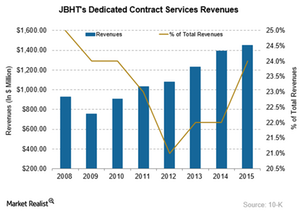

J.B. Hunt Transport’s Dedicated Contract Services Division

J.B. Hunt Transport (JBHT) has a network of roughly 89 cross-dock locations throughout the US to support the company’s final-mile, or last-mile, delivery services.

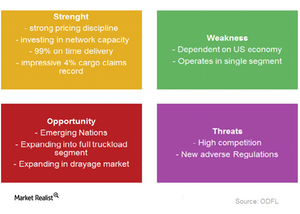

What are ODFL’s most significant strengths and weaknesses?

Old Dominion Freight Line (ODFL) has a strong pricing discipline and best-in-class service capabilities.

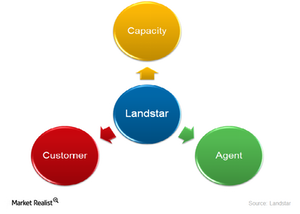

A look at Landstar’s business model

Landstar’s success is highly dependent on high revenue-generating sales reps, as well as on the volume increases by BCOs and customers.

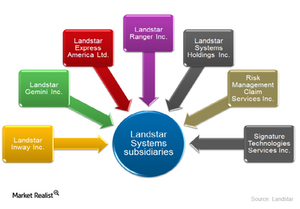

How Landstar System makes money

Landstar’s success lies in its ability to provide a complete logistics solution through various transportation modes and up-to-date technology.

J.B. Hunt’s Integrated Capacity Solutions segment

J.B. Hunt’s (JBHT) Integrated Capacity Solutions segment provides non-asset, asset-light, traditional freight brokerage and transportation logistics solutions to customers.