Heartland Express Inc

Latest Heartland Express Inc News and Updates

Will Rise in Crude Oil Benefit US Truckload Carriers in 2018?

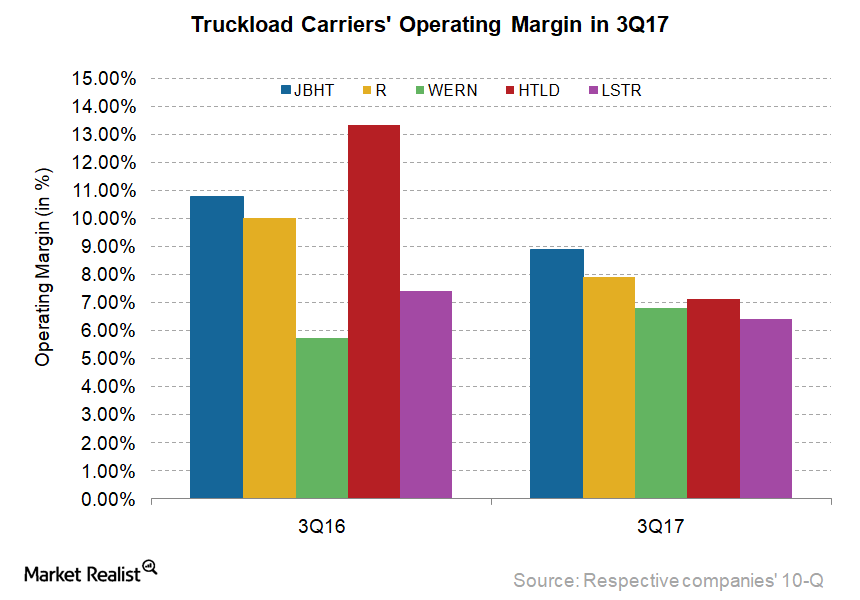

The average US on-highway diesel prices in 3Q17 have risen 20% compared to the same quarter last year.

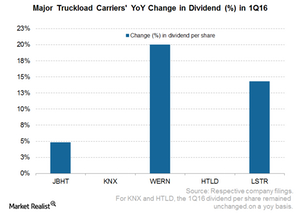

Which US Truckload Carrier Holds First Place in Dividend Growth?

Among major truckload companies, in 1Q16, Werner Enterprises (WERN) declared the highest dividend growth, at $0.06 per share, which is a 20% YoY increase.