What Does Roche’s Valuation Indicate?

On June 21, 2016, Roche Holding (RHHBY) was trading at a forward PE (price-to-earnings) multiple of 14.8x.

June 23 2016, Updated 3:31 p.m. ET

Roche’s valuation

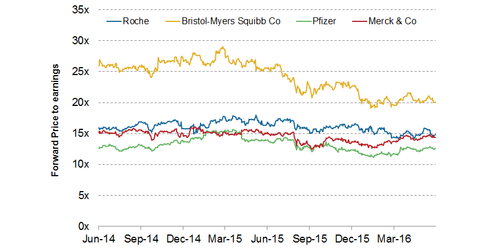

On June 21, 2016, Roche Holding (RHHBY) was trading at a forward PE (price-to-earnings) of 14.8x. Roche’s forward PE was at a discount when compared with Bristol-Myers Squibb (BMY), which was trading at a forward earnings multiple of 20.12x. Merck (MRK) and Pfizer (PFE) were trading at 14.42x and 12.64x of their forward earnings, respectively.

Lower sales growth and potential biosimilar threats to its multi-billion dollar drugs might be one of the reasons for Roche’s discounted valuation. To understand the biosimilars threat, read How Biosimilars Could Threaten Roche’s Key Products.

Valuation multiples

Roche’s average PE over the past two-year period stood at 16.09x of its future earnings. It ranged from 14x–18x of its estimated earnings. So, its current multiple of 14.8x seems to be at the lower end of its two-year historic PE. Roche’s median PE over the past two years is 16.05x of its forward earnings.

Roche is recording consistent sales growth. During 1Q16, its sales rose annually by 4% on a constant exchange rate basis to 12.4 billion swiss francs. In the next article, we’ll analyze Roche’s performance based on its operating efficiency.

The share price of a biotechnology company fluctuates with changing market dynamics along with the number of late-stage pipeline products. As a result, it’s often risky to directly invest in a pharma or biotech company. Thus, to remain on the safer side, investors can choose the Vanguard FTSE All-World Ex-US Index Fund (VEU), which holds 0.6% of its total holdings in Roche stock.