Why Is the Iron Ore Price Rally Losing Steam?

In this series, we’ll analyze the demand-supply fundamentals for iron ore and see whether the recent surge was a one-off phenomenon or the start of a more sustained uptick in prices.

June 1 2016, Updated 4:30 p.m. ET

The iron ore price rally

Commodities (COMT) have rallied in 2016 despite many analysts believing to the contrary. Iron ore, in particular, has enjoyed a spectacular run from after the Chinese New Year through April. Prices saw the biggest one-day gain of 19% in March. April saw prices going above $70 per ton compared to a low of $38 per ton in December 2015.

Iron ore prices have remained volatile in May. They fell ~20% from May 1–27, 2016. There are many opinions about the reason for the rally. Some believe speculative trading was behind the run-up. Others believe it could have been the Chinese economic stimulus, seasonal restocking, or a temporary spike due to a mandated shutdown of production for a flower show. We’ll take a closer look at these and their sustainability throughout the series.

Performances of iron ore miners

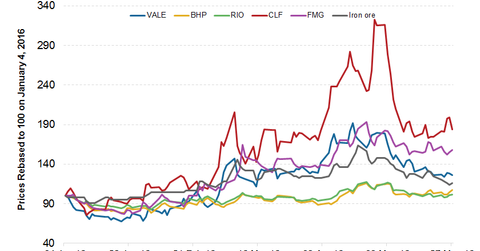

With stronger iron ore prices year-to-date, iron ore miners have recuperated from some of their losses. Cliffs Natural Resources (CLF) has outperformed with a YTD (year-to-date) rise of 184% as of May 27, 2016. Fortescue Metal (FSUGY) and Vale (VALE) have risen 58% and 26%, respectively. Rio Tinto (RIO) and BHP Billiton (BHP) (BBL) have risen 2% and 7%, respectively.

In this series

In this series, we’ll analyze the demand-supply fundamentals for iron ore and see whether the recent surge was just a one-off phenomenon or the start of a more sustained uptick in prices. We’ll look at Chinese steel production growth, supply-side growth, speculative trading, inventory of iron ore, and analysts’ recommendations to arrive at the potential future upside or downside in prices. These factors should help you form a view regarding the future direction of iron ore prices.

In the next part of this series, we’ll look at the current supply dynamics in the iron ore sector.