Why Predicting Gold Returns Is a Dubious Exercise

Generally, gold is viewed as a hedge against rapid inflation and lower interest rates. That makes it hard to value gold as there are no cash flows or earnings associated with it.

June 8 2016, Updated 2:05 p.m. ET

Even more than other asset classes, making predictions about gold is a dubious exercise. For starters, investors can barely agree on what gold is: commodity, currency or “barbaric relic.” Even investors like myself, who see a legitimate role for gold in a portfolio, need to admit that gold is extremely difficult to value. There is no cash flow to discount and, unlike oil or even other precious metals like silver or platinum, gold has few industrial uses.

Market Realist – Gold is very difficult to value

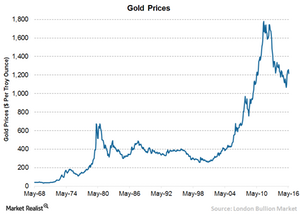

Normally, people turn to gold (IAU) during uncertain times. However, this is not always true as in the past when gold also moved higher when the market (IVV) was booming. Additionally, gold has previously behaved differently during the identical economic scenarios.

For example, gold performed well from 2000 and hit a high of $1,860 per ounce in 2011 amid uncertain global growth. However, during the subsequent four years, gold declined consistently despite the slowing US economy and the European financial crisis. Thus, it is very difficult to predict the movement of gold (SGOL).

Don’t extrapolate

Kenneth Rogoff, professor of economics at Harvard University, noted that “gold and reason are difficult to reconcile.” He further pointed out, “Most economic research suggests that gold prices are very difficult to predict over the short to medium term, with the odds of gains and losses being roughly in balance. It is, therefore, dangerous to extrapolate from short-term trends.”

No valuation tool

Generally, gold (GLD) is viewed as a hedge against rapid inflation and lower interest rates. That makes it hard to value gold as there are no cash flows or earnings associated with it. In addition, no valuation tool exists to find the intrinsic value of gold (DGL) like the DCF (discounted cash flow) or even a simple metric like the price-to-earnings multiple used for stocks.

Additionally, only around 10% of gold demand is from industrial uses, with the balance coming from jewelry and investment.

Numerous factors influence gold

Historically, there are several factors that influence the price of gold, such as interest rate movement, inflation, demand and supply, dollar strength, and overall economic conditions. However, the forecast of gold price movement in the short term is a doubtful exercise filled with inconsistency.