Why Did Crude Oil Prices Diverge before OPEC’s Meeting?

July WTI (West Texas Intermediate) crude oil futures contracts trading in NYMEX fell by 0.47% and settled at $49.1 per barrel on Tuesday, May 31, 2016.

June 1 2016, Published 10:09 a.m. ET

Crude oil prices

July WTI (West Texas Intermediate) crude oil futures contracts trading in NYMEX fell by 0.47% and settled at $49.1 per barrel on Tuesday, May 31, 2016. In contrast, Brent crude oil futures contracts trading on the Intercontinental Exchange rose by 0.75% to $49.69 per barrel. Brent crude oil prices rose ahead of OPEC’s (Organization of the Petroleum Exporting Countries) meeting on June 2, 2016. US crude oil prices fell ahead of the US inventory report. ETFs like the United States Oil ETF (USO) and the ProShares Ultra Bloomberg Crude Oil (UCO) fell by 0.92% and 1.8%, respectively, on May 31.

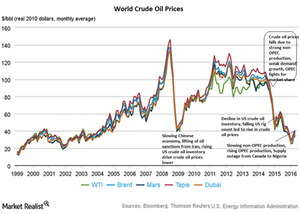

Crude oil prices in 2014, 2015, and 2016

History suggests that crude oil prices are volatile. US crude oil prices rose to a peak level of $107 per barrel in June 2014. Then, Brent and WTI crude oil prices started to decline due to strong non-OPEC crude oil production, weak demand growth, and OPEC’s objective to maintain market share. However, prices started to recover in 2015 due to the slowing US crude oil inventory and the fall in the US rig count. However, prices started to fall in late 2015 and early 2016 due to the slowing Chinese economy, lifting of Iran’s sanctions, and rising US crude oil inventory.

Brent and WTI crude oil prices

Meanwhile, Brent crude oil prices rose to $50.51 on May 26—their highest level since early November 2015. Likewise, WTI crude oil tested $50.21 on May 26—its highest level since October 2015. Read Is the Supply Side of the Crude Oil Market Rebalancing? and Demand Side of the Crude Oil Market: India Is a Bright Spot for more on supply and demand drivers and their impact on crude oil prices.

The volatility in crude oil prices impacts oil producers like Matador Resources (MTDR), Goodrich Petroleum (GDP), and Bill Barrett (BBG). They also impact ETFs and ETNs such as the iShares US Oil Equipment & Services (IEZ), the United States Brent Oil ETF (BNO), and the ProShares UltraShort Bloomberg Crude Oil (SCO).

What’s in this series?

This series focuses on US crude oil inventories, OPEC’s meeting and its impact on crude oil prices, Saudi Arabia’s state of mind ahead of OPEC’s meeting, Iran’s oil production strategies, and crude oil price forecasts.