What Could Benefit J.M. Smucker’s 4Q16 Earnings?

Analysts are expecting J.M. Smucker’s adjusted EPS to be $1.19 in fiscal 4Q16—compared to 4Q15 EPS of $0.98. It represents a tremendous rise of 21%.

June 6 2016, Updated 9:08 a.m. ET

Earnings per share

In the previous parts, we discussed the estimated revenue for J.M. Smucker (SJM) for fiscal 4Q16 and what could drive revenue growth. Now, let’s look at analysts’ EPS (earnings per share) estimates and management’s guidance for 2016.

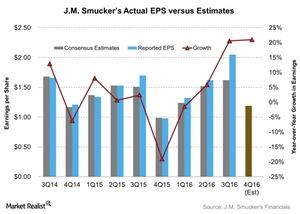

Fiscal 4Q16 EPS estimates

Analysts are expecting J.M. Smucker’s adjusted EPS to be $1.19 in fiscal 4Q16—compared to 4Q15 EPS of $0.98. It represents a tremendous rise of 21%. In the above chart, you can see that the company beat analysts’ expectations in all of the quarters in fiscal 2016. We can expect the trend to continue in 4Q16 as well. For fiscal 2016, analysts expect earnings to rise by 7% to $5.78—compared to an EPS of $5.38 in fiscal 2015.

Outlook for 2016

J.M. Smucker raised its earnings guidance during its 3Q16 earnings release. Now, the updated adjusted non-GAAP (generally accepted accounting principles) EPS range is $6.99–$7.09 excluding the amortization expense of ~$1.15 per share.

The updated guidance includes $35 million of synergies related to the Big Heart acquisition. Of that, ~$15 million is expected to be realized in fiscal 4Q16. The revised earnings guidance also reflects the $0.14 per share gain from the US canned milk divestiture.

However, it excludes an estimated non-cash deferred tax benefit of ~$50 million associated with the integration of Big Heart into the company

Earnings estimate for peers

J.M. Smucker’s peers in the packaged food industry include McCormick & Company (MKC), Lancaster Colony (LANC), and Flowers Foods (FLO).

- McCormick & Company’s EPS for fiscal 2Q16 is expected to fall by 1%.

- Lancaster Colony’s EPS for fiscal 4Q16 is projected to rise by 11%.

- Flowers Foods’ EPS for fiscal 2Q16 is expected to rise by 3%.

To gain exposure to J.M. Smucker, you can invest in the PowerShares S&P 500 Quality Portfolio (SPHQ) and the PowerShares S&P 500 Low Volatility Portfolio (SPLV). They invest ~2% of their portfolio in J.M. Smucker.