A Look at Foot Locker’s Cost Structure, Expanding Profitability

As part of its long-term plan, Foot Locker (FL) has been concentrating on enhancing its profitability margins and focusing on store remodels and improved service and product assortment.

Nov. 22 2019, Updated 5:44 a.m. ET

Why Foot Locker’s profitability is rising

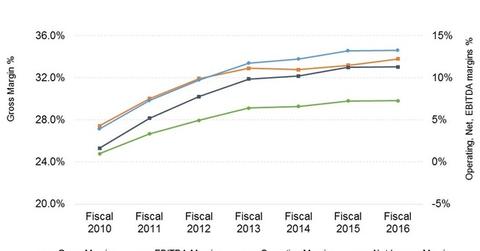

As part of its long-term plan, Foot Locker (FL) focuses on store remodels, improved service, and product assortment. The company has also been concentrating on enhancing its profitability margins over the past few years. Below is how Foot Locker has been performing:

- Its gross margin has increased 380 basis points, rising from 30.0% in fiscal 2011 to 33.8% in fiscal 2016.

- Its operating income margin has more than doubled, rising from 5.2% in fiscal 2011 to 11.3% in fiscal 2016.

- Its EBITDA (earnings before interest, tax, depreciation, and amortization) margin has increased 600 basis points, rising from 7.3% in fiscal 2011 to 13.3% in fiscal 2016.

Peer group comparisons

Below are the earned operating income margins for some other sporting goods retailers (XLY) in their last fiscal years:

The operating income margins for these companies have been declining over the past few years. This is largely due to sales headwinds and product margin pressures.

Sources of Foot Locker’s profitability upside

Foot Locker’s improvement in profitability margins has occurred on several fronts. First, the company has been able to sell in greater volume and at higher average selling prices. Due to high product demand, particularly for Nike (NKE) products, markdowns have been less.

Second, the retailer has invested in fewer new stores. FL has concentrated on revamping or converting existing stores, and as a result, its store count has declined. That’s helped the company employ leverage at the operating costs level.

Foot Locker’s growth rate in online sales has surpassed the brick-and-mortar stores, as we saw in Part 9. While profitability margins for both channels aren’t markedly dissimilar, online sales have earned slightly higher margins in the last three years.

Foot Locker’s profitability outlook

Foot Locker is projecting further increases in profitability in the coming years. As part of its five-year plan through fiscal 2021, it expects its gross margin to increase 33.5%–34%.

Operating income margin is also expected to increase by more than 100 basis points to 12.5% by the end of the projection period. The company also expects its net income margin to increase by 120 basis points to 8.5% in the same period. However, the company could face higher shipping costs as customers are increasingly expecting free shipping for their web purchases.