DSW Inc

Latest DSW Inc News and Updates

How Foot Locker Has Stepped Up Inventory Management Efforts

In recent quarters, Foot Locker (FL) has made inventory management a priority. The retailer is targeting faster inventory turns.

DSW’s Fiscal 4Q17 Results Were a Mixed Bag

DSW posted sales of ~$720 million in fiscal 4Q17, which was below the analyst estimate of $728.2 million.

J.P. Morgan Raises Foot Locker’s Price Target, Adds to Focus List

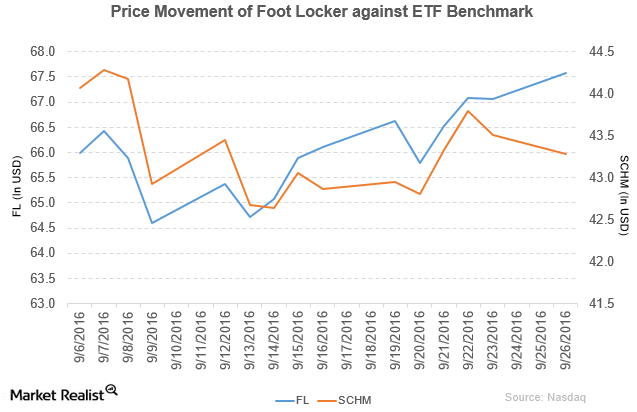

Foot Locker (FL) has a market cap of $9.0 billion. It rose 0.76% to close at $67.58 per share on September 26.

Why Did Foot Locker’s Price Target Rise?

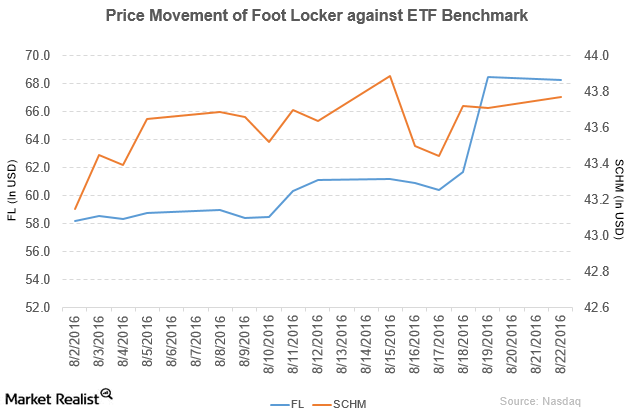

Foot Locker has a market cap of $9.3 billion. It fell by 0.35% and closed at $68.25 per share on August 22, 2016. It reported fiscal 2Q16 sales of $1.8 billion.