Cabela's Inc

Latest Cabela's Inc News and Updates

How Foot Locker Has Stepped Up Inventory Management Efforts

In recent quarters, Foot Locker (FL) has made inventory management a priority. The retailer is targeting faster inventory turns.

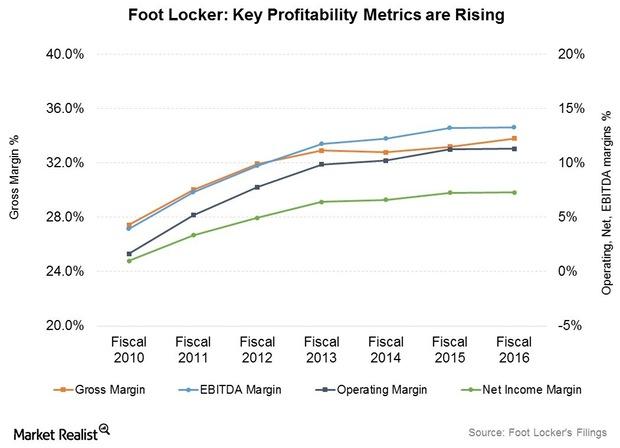

A Look at Foot Locker’s Cost Structure, Expanding Profitability

As part of its long-term plan, Foot Locker (FL) has been concentrating on enhancing its profitability margins and focusing on store remodels and improved service and product assortment.

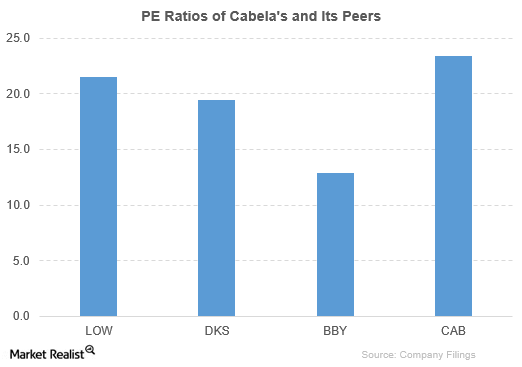

How Does Cabela’s Compare to Its Peers?

Cabela’s peers have outperformed the company based on PBV. However, Cabela’s has outperformed its peers based on PE and PS.

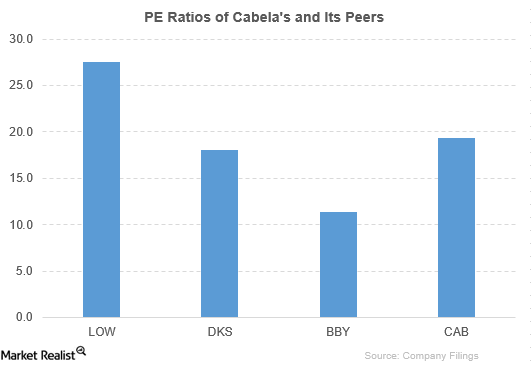

How Does Cabela’s Compare to Its Peers after 2Q16 Earnings?

Cabela’s (CAB) has been outperformed by its peers based on PBV (price-to-book value) ratio. However, Cabela’s has mostly outperformed its peers based on PE (price-to-earnings) and price-to-sales ratios.

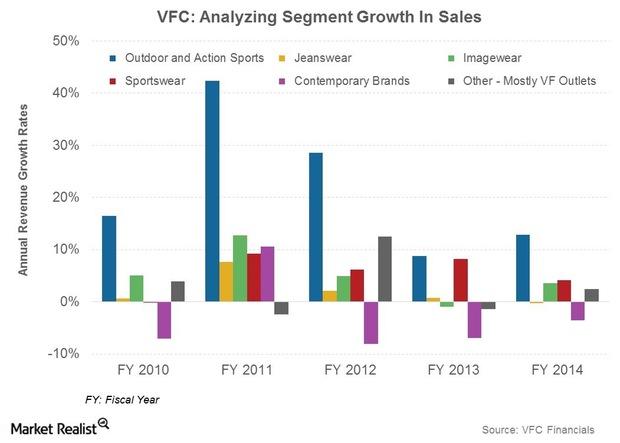

VF Corporation’s Big 3 And Other Brands In The Making

The company’s three major brands—The North Face, Vans, and Timberland—all reported double-digit growth rates in the quarter.