Cloud Peak Energy Topped EBITDA Margin Growth in 2Q16

Cloud Peak Energy reported positive growth in its 2Q16 EBITDA margins. Cloud Peak Energy’s EBITDA margins came in at 11.1% in 2Q16.

Sept. 5 2016, Updated 10:04 a.m. ET

2Q16 EBITDA

EBITDA (earnings before interest, tax, depreciation, and amortization) is an important metric used in understanding operational performance. A higher EBITDA implies higher income from ongoing operations.

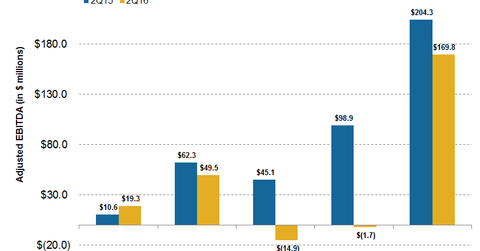

For 2Q16, Cloud Peak Energy’s (CLD) adjusted EBITDA came in at -$19.3 million—compared to $10.6 million in 2Q15. Arch Coal’s (ACIIQ) adjusted EBITDA came in at -$14.9 million—compared to $45.1 million in 2Q15.

Peabody Energy’s (BTUUQ) 2Q16 adjusted EBITDA came in at -$1.7 million—compared to $98.9 million in 2Q15. Alliance Resource Partners (ARLP) reported its 2Q16 adjusted EBITDA at $169.8 million—down from $204.3 million in 2Q15.

Among major coal mining companies, Cloud Peak Energy (CLD) is the only company that reported a YoY increase in adjusted EBITDA. Westmoreland Coal’s adjusted EBITDA from its coal mining operations in 2Q16 came in at $49.5 million—compared to $62.3 million in 2Q15.

EBITDA margins

Of the major coal (KOL) mining companies, Cloud Peak Energy and Alliance Resource Partners reported positive growth in their 2Q16 EBITDA margins. Cloud Peak Energy’s EBITDA margins came in at 11.1% in 2Q16—compared to 4.3% in 2Q15. Alliance Resource Partners’ EBITDA margins came in at 38.7%—compared to 33.8% in 2Q15.

Arch Coal and Peabody Energy had negative EBITDA margins for 2Q16. Peabody Energy’s EBITDA margin dropped from 7.4% in 2Q15 to -0.2% in 2Q16. Arch Coal’s EBITDA margin dropped from 7.0% in 2Q15 to -3.5% in 2Q16.

Westmoreland Coal’s (WLB) EBITDA margin came in at 14.5%—down from 18.5% in 2Q15. The Power segment’s EBITDA wasn’t included in the comparison.

What helped Cloud Peak Energy?

According to company filings, the increase in adjusted EBITDA and EBITDA margins is mainly due to the recognition of $18.8 million of sales contract buyout revenue in 2Q16 compared to none in 2Q15. Also, an increase in the cash margin per ton of coal sold helped the company post a higher EBITDA value on a YoY basis.

Next, we’ll look at major coal mining companies’ bottom lines in 2Q16.