ACIIQ

Latest ACIIQ News and Updates

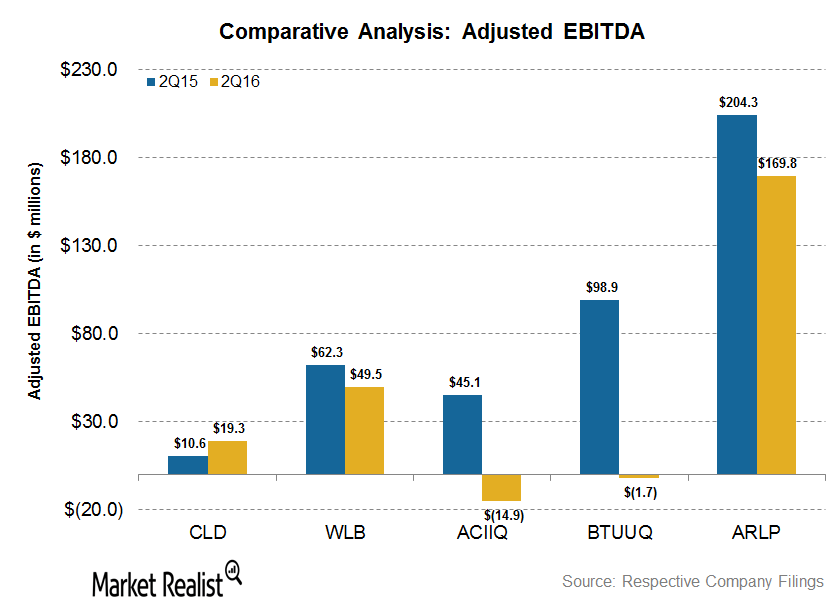

Cloud Peak Energy Topped EBITDA Margin Growth in 2Q16

Cloud Peak Energy reported positive growth in its 2Q16 EBITDA margins. Cloud Peak Energy’s EBITDA margins came in at 11.1% in 2Q16.

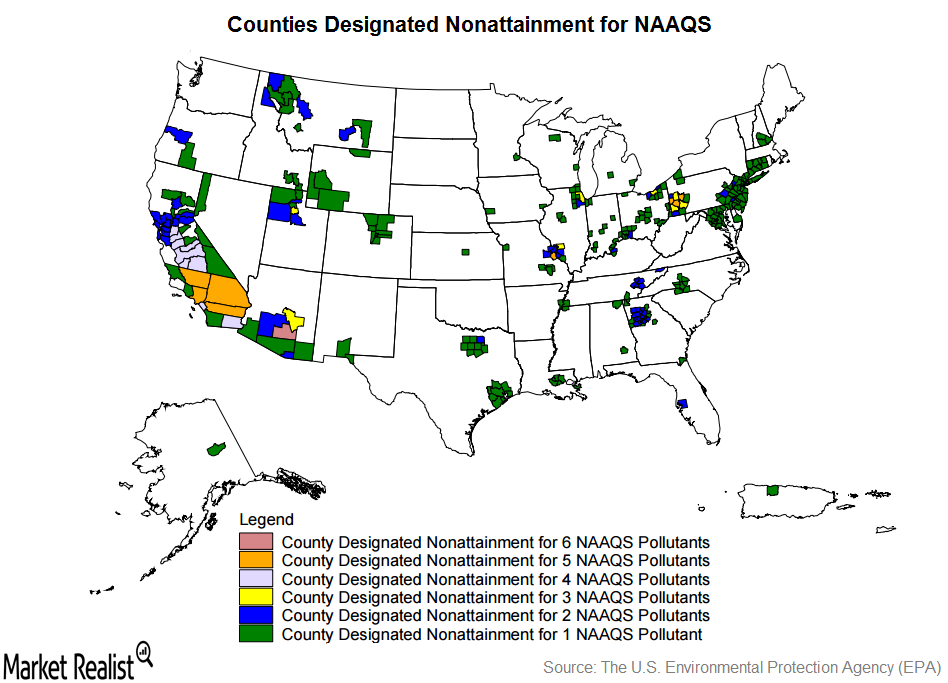

How Developments in the Clean Air Act Will Impact Coal Mining

The Clean Air Act is a national air pollution control policy that regulates the emission of hazardous pollutants from stationary and mobile sources in the United States.

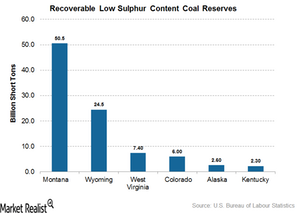

Where Are the Low Sulphur Content Coal Mines in the US?

According to the EIA, low sulphur content coal is defined as having less than 0.60 pounds of sulphur per million British thermal units.

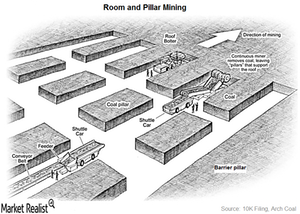

How Is Coal Mined in the US?

According to the World Coal Association, there are two main underground mining methods in the US.

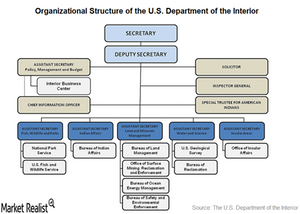

How Does the Land Ownership Pattern in the US Affect Miners?

Land ownership in the US can be broadly divided into the following categories: federally owned land, state-owned land, privately owned land, and Native American land.

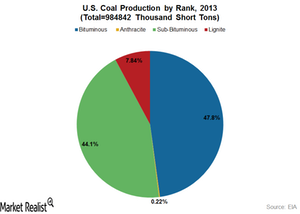

What Are the Different Types of Coal?

Coal types differ from each other as a result of the difference in their organic matter content and maturity.