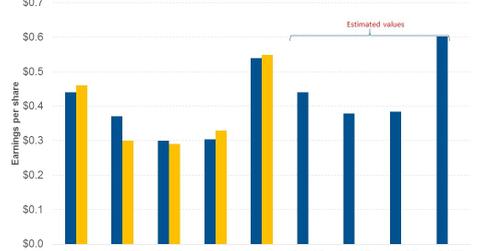

Texas Roadhouse’s 1Q16 EPS Was below Analyst’s Expectations?

In 1Q16, Texas Roadhouse posted EPS of $0.5. This was lower than analysts’ estimate of $0.54. The adjusted EPS was above analysts’ estimate at $0.55.

Dec. 4 2020, Updated 10:52 a.m. ET

EPS growth

In 1Q16, Texas Roadhouse (TXRH) posted EPS (earnings per share) of $0.5. This was lower than analysts’ estimate of $0.54. However, the adjusted EPS stood at $0.55. This was above analysts’ estimates. It represented growth of 16.1% from $0.46 in 1Q15. The settlement charges on a wage-per-hour demand with the Delaware Department of Labor had an impact on the EPS by -$0.05.

Growth in adjusted EPS

The growth in adjusted EPS was due to revenue growth of 12.1% and operation margin expansion from 19% in 1Q15 to 20.1%. The EPS growth in 1Q16 was also positively impacted by share purchases in the last 12 months. The company purchased shares worth $27.4 million. Repurchasing shares reduces the shares outstanding. This increases the EPS.

Peer comparison

In 2Q16, Texas Roadhouse’s peers Bloomin’ Brands (BLMN), Buffalo Wild Wings (BWLD), and Brinker International (EAT) posted EPS growth of -2.1%, 12.6%, and 5.7%, respectively.

Outlook

Texas Roadhouse forms 0.55% of the holdings of PowerShares DWA Momentum Portfolio (PDP). Analysts expect Texas Roadhouse to post EPS of $0.44, $0.38, $0.38, and $0.6 in 2Q16, 3Q16, 4Q16, and 1Q17, respectively. Positive 1Q16 results prompted analysts to increase their 2Q16 estimates from $0.42 earlier. For fiscal 2016, analysts expect Texas Roadhouse to post EPS of $1.8. This represents growth of 27.1% from $1.4 in 2015.