PVH’s Tommy Hilfiger Gets Boost from Strong International Sales

Tommy Hilfiger was acquired by PVH (PVH) in 2010. In fiscal 2015, the Tommy Hilfiger brand accounted for 43.5% of the company’s total revenue and 44% of its operating profit.

June 1 2016, Updated 8:06 a.m. ET

Tommy Hilfiger brand overview

Tommy Hilfiger was acquired by PVH (PVH) in 2010. In fiscal 2015, the Tommy Hilfiger brand accounted for 43.5% of the company’s total revenue and 44% of its operating profit.

PVH reports its Tommy Hilfiger business under two segments:

- Tommy Hilfiger North America

- Tommy Hilfiger International

Tommy Hilfiger’s top line in fiscal 1Q16

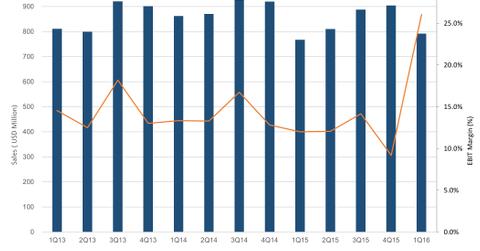

Tommy Hilfiger registered a 4% YoY (year-over-year) growth on a constant currency basis and a 3% growth on a GAAP (generally accepted accounting principles) basis in fiscal 1Q16. Fueling that growth was an improvement in Tommy Hilfiger International sales, which were partially offset by the softness in the Tommy Hilfiger North America sales.

Revenue for Tommy Hilfiger North America decreased 5% on both a constant currency and GAAP basis due to a decline in retail sales. The segment’s comparable store sales declined 10% due to continued weakness in traffic and consumer spending trends in the Tommy Hilfiger US stores located in international tourist locations.

Revenue for Tommy Hilfiger International increased 11% on a constant currency and GAAP basis. This growth was driven by continued momentum across Europe, which was fueled by an 8% increase in comparable store sales and strong wholesale growth in the region. In addition, the company’s acquisition of the remaining 55% interest in TH Asia, PVH’s joint venture for Tommy Hilfiger in China, contributed to the increase in Tommy Hilfiger International revenue in the quarter.

A look at Tommy Hilfiger’s profitability

Tommy Hilfiger’s EBIT (earnings before interest and taxes) increased 20% on a constant currency basis, driven by an increase in Tommy Hilfiger International revenue and a gross margin improvement in Europe. This increase was partially offset by an earnings decline in Tommy Hilfiger’s North American business due to weak international tourist traffic and lower spending in US stores.

EBIT stood at $206 million on a GAAP basis and $85 million on a non-GAAP basis compared to $92 million in 1Q15.

PVH is part of the S&P 500 Apparel and Accessories Index. Other companies in the index include Coach (COH), Hanesbrands (HBI), Michael Kors (KORS), and Ralph Lauren (RL). Investors who want exposure to PVH and these other companies can consider the SPDR S&P 500 ETF (SPY), which invests 0.25% of its portfolio in them.

In the next part of this series, we’ll take a look at the 1Q16 performance of PVH’s Calvin Klein brand.