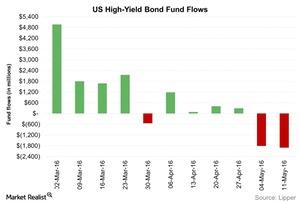

How Did High Yield Bond Fund Outflows Do Last Week?

Investor flows into high yield bond funds were negative last week for the second consecutive week. Net outflows from high yield bond funds totaled $1.9 billion.

May 31 2016, Updated 1:05 a.m. ET

Investor flows into high yield bond funds

Investor flows into high yield bond funds were negative for the second consecutive week. According to Lipper, net outflows from high yield bond funds totaled $1.9 billion in the week ended May 11, 2016. It was the third largest outflows YTD (year-to-date). In the previous week, high yield bond funds saw net outflows of $1.8 billion. With the outflows last week, high yield bond funds have witnessed YTD inflows of $6.0 billion.

Yields and spreads analysis

Yields on high yield debt and spreads between high yield debt and Treasuries fell over the week ended May 13, 2016.

High yield debt yields, as represented by the BofA Merrill Lynch US High Yield Master II Effective Yield, fell 10 basis points from a week ago and ended at 7.7% on May 13, 2016.

Like yields, the option-adjusted spread (or OAS) fell last week. The BofA Merrill Lynch US High Yield Master II Option-Adjusted Spread fell 7 basis points from last week to end at 6.4% on May 13.

Returns on high yield debt indexes, mutual funds, and ETFs

Bond yields and prices move in opposite directions. With yields falling, returns on high yield debt rose in the week ended May 13, 2016. The BofA Merrill Lynch US High Yield Master II Index rose 0.5% over the week. Returns in 2016 were positive, with the index rising 7.3% YTD.

Mutual funds such as the American Funds American High-Income Trust – Class A (AHITX) and the PIMCO High Yield Fund – Class A (PHDAX) provide exposure to high yield debt. Weekly returns of AHITX and PHDAX rose marginally by 0.1% and 0.2%, respectively.

Popular exchange-traded funds providing exposure to high yield debt rose over the week. Prices of the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and the SPDR Barclays Capital High Yield Bond ETF (JNK) rose 0.3% each over the week ended May 13, 2016.

In the primary market, Cheniere Corpus Christi Holdings, a wholly owned subsidiary of Cheniere Energy (LNG); NRG Energy (NRG); The Goodyear Tire & Rubber Company (GT); and Tesoro Logistics (TLLP), a subsidiary of Tesoro (TSO) were some of the issuers of high-yield bonds. You can read more about the primary market activity in Part 3 of this series.

In the next part, we’ll take a look at primary market activity in leveraged loans.