How Do Chinese Copper Demand Indicators Look This Month?

It’s important for investors in companies such as Freeport-McMoRan, BHP Billiton, and Rio Tinto to track Chinese copper demand indicators.

Sept. 22 2016, Updated 12:04 p.m. ET

Chinese copper demand

Since China is the world’s largest copper consumer, it’s important for investors in companies such as Freeport-McMoRan (FCX), BHP Billiton (BHP), and Rio Tinto (RIO) (TRQ) to keep track of Chinese copper demand indicators.

Notably, one of the factors that helped the rally in metals and mining shares this year has been the improvement in China’s economic indicators. China’s property market saw a rebound this year due to the government stimulus. However, the impact of these stimulus measures has been fading.

Indicators fall

- Purchasing land is generally a prerequisite before building can occur. The land area purchased by Chinese real estate enterprises for future developments has fallen 8.5% YoY (year-over-year) in the first eight months of 2016. The rate of decline was higher by 0.9 percentage points—compared to the first seven months of the year.

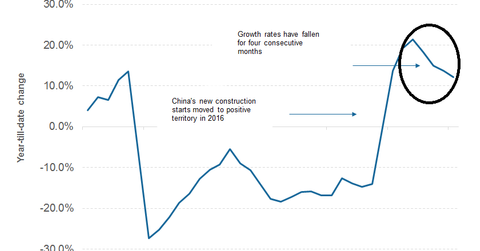

- The total floor area (in square meters) under construction by Chinese real estate development enterprises rose 4.6% in the first eight months of 2016. The growth rate fell 0.2 percentage points—compared to the first seven months of the year. This was the fourth consecutive month in which growth rates fell on a monthly basis.

- China’s new construction starts rose 12.2% YoY in the first eight months of 2016 after falling steadily for two years, as you can see in the above graph. However, the growth rate fell compared to the first seven months of the year.

We have seen moderation in Chinese real estate activity after a big spike earlier this year. The slowdown in Chinese construction activity is negative for metals (DBC).

Although Chinese real estate activity has slowed down, the country’s car sales are still going strong. We’ll explore this more in the next part.