How Did Tesoro’s Stock Perform Pre-1Q17 Earnings?

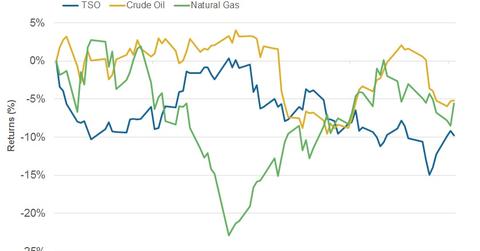

Since January 3, 2017, TSO stock has fallen 9.8%. Comparatively, crude oil prices have fallen 5.2%, and natural gas prices have fallen 5.6% year-to-date.

May 1 2017, Updated 10:40 a.m. ET

Tesoro’s stock performance

Earlier, we looked at Tesoro’s (TSO) 1Q17 estimates and refining margin expectations. Now, we’ll evaluate TSO’s stock performance prior to its results, which are expected to be released on May 8, 2017.

Since January 3, 2017, TSO stock has fallen 9.8%. Comparatively, crude oil prices have fallen 5.2%, and natural gas prices have fallen 5.6% year-to-date. TSO’s correlation coefficient with crude oil was 0.23 in the past 12 months.

TSO plunges in 2017

On February 6, 2017, Tesoro announced its 4Q16 earnings, which fell steeply. For more information, read Tesoro Stayed Positive despite the Fall in Its 4Q16 Earnings.

To add to TSO’s woes, in February, the EIA (U.S. Energy Information Administration) announced five-year high distillate inventories for the week ended February 3, 2017. This announcement was followed by an announcement of high gasoline inventories for the week ended February 10, 2017. These inventories have since been failing.

The adverse impact of TSO’s 4Q16 earnings and high gasoline and distillate inventories in the industry likely led to the downfall in Tesoro stock.

Peer comparison

Since January 3, 2017, HollyFrontier (HFC), Western Refining (WNR), and PBF Energy (PBF) fell 16%, 10%, and 19%, respectively. For mid-cap stock exposure, investors can consider the SPDR S&P MIDCAP 400 ETF (MDY). The ETF also has ~3% exposure to energy sector stocks, including HFC and WNR.

In the next article, we’ll discuss analysts’ ratings on Tesoro before its 1Q17 earnings release.