What Do Widening Bond Spreads Indicate?

Widening spreads indicate a slowing economy. Since companies are more likely to default in a slowing economy, credit risk related to their bonds rises.

Nov. 22 2019, Updated 7:26 a.m. ET

Bond spreads hint at economic conditions

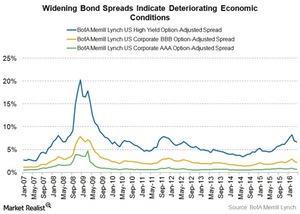

Bond spreads tighten with improving economic conditions and widen with deteriorating economic conditions. You can see evidence of these trends in spreads’ behaviors during the credit crisis of 2008–2009.

Bond spreads as economic indicators

In terms of business cycles, widening spreads indicate a slowing economy. Since companies are more likely to default in a slowing economy, the credit risk related to their bonds rises. For this reason, investors command additional interest on corporate bonds.

Yields on corporate bonds rise, especially in the high-yield (HYG) or junk (JNK) categories. These categories are more likely to default compared to investment-grade (LQD) or Treasury (TLT) bonds. The difference (or spread) between the interest paid on near risk-free Treasuries and the interest paid on these bonds then increases (or widens).

A rate hike would impact bond spreads

Taking a look at the trend in credit spreads historically, we can see that spreads in the United States rose from mid-2014 to February 2016. Though credit spreads have taken a turn since then, moderating downward a bit, they are still at recession levels.

Further rate hikes by the Federal Reserve will be a sign of the Fed’s seeing improving economic conditions in the United States. This improvement would result in a fall in credit spreads.

The higher the spread, the more credit risk your investment in fixed income (BND) (AGG) bears. As long as any further rate hike is delayed by the Fed, you can expect spreads to continue to moderate.