What’s Monsanto’s Outlook for the Next 12 Months?

For fiscal 2Q16, Monsanto reported EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.8 billion.

April 14 2016, Updated 1:06 p.m. ET

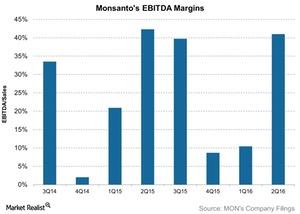

EBITDA margins

Monsanto (MON) is undergoing restructuring to cope with the challenging agricultural environment. Previously, the company stated that it would eliminate 1,000 jobs. Along with its previous job eliminations, this puts total eliminations at 3,600 positions.

For fiscal 2Q16, Monsanto reported EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.8 billion, which came in better than analysts’ expectations of $1.75 billion. The company’s fiscal 2Q16 reported EBITDA translated into a 41% margin, which fell from 42.3% a year ago in fiscal 2Q15.

During the company’s earnings call, management stated that it expected $165 million–$210 million in savings to come from its restructuring activities in fiscal 2016. Restructuring continues to contribute to Monsanto’s margin expansion.

While the U.S. Department of Agriculture’s recent Prospective Plantings Report showed that US corn acreage is expected to rise this season, the rise will be offset by expected falls in corn acres in Argentina and Europe.

Monsanto’s outlook

Monsanto expects currency impacts to be around $400 million for its Seeds and Genomics segment and expects to have expenses rise by about $180 million. For fiscal 2Q16, Monsanto had an effective tax rate of 25%. The company expects the tax rate to be in the range of 24%–27% for the year. Lately, currency headwinds have been an issue for many players in the market (NANR).

The company’s net debt-to-12-month EBITDA, or leverage ratio, following fiscal 2Q16 stood at 2.5x, which it expects to fall to 1.5x–2x by the end of the year. Syngenta (SYT) has a leverage ratio of 0.97x, DuPont (DD) has a leverage ratio of 0.57x, and Agrium (AGU) has a leverage ratio of 2.3x.

Next, we’ll look at analysts’ ratings and recommendations for Monsanto for the next 12 months.