Is Vivint Solar Trading at a Discount Compared to Its Peers?

One out of four analysts covering Vivint Solar (VSLR) has rated the stock a “buy,” two analysts rated the stock a “hold,” and one analyst recommends a “sell” for the stock.

April 8 2016, Updated 11:06 a.m. ET

Relative valuation

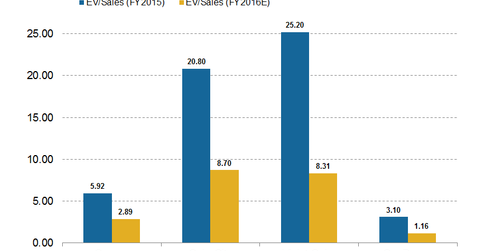

Relative valuation helps to compare a firm’s value relative to its peer’s value. The enterprise value-to-sales ratio represents the value created per dollar of sales made by the company during a year. Therefore, the higher enterprise value-to-sales ratio implies that the company is overvalued compared to its peers.

However, these multiples have to be considered with caution as higher EV-to-sales also imply higher value addition to a company from higher sales in future.

Among the downstream solar (TAN) companies, SolarCity (SCTY) has the highest EV-to-sales value of 8.70, which is closely followed by Vivint Solar (VSLR) with EV-to-sales ratio of 8.31. Analysts expect that Sunrun’s (RUN) EV-to-sales ratio to be 2.89x in fiscal 2016 compared to 5.92 in fiscal 2015.

Whereas, SunPower’s (SPWR) EV-to-sales ratio is anticipated to be around 1.16s for fiscal 2016 compared to 3.10x in fiscal 2015. This implies higher revenue on a year-over-year basis.

Analysts’ ratings of Vivint Solar

One out of four analysts covering Vivint Solar (VSLR) has rated the stock a “buy,” two analysts rated the stock a “hold,” and one analyst recommends a “sell” for the stock. According to analysts’ estimates, the consensus 12-month target price of VSLR was $4.75 as of March 29, 2016. Considering the closing stock price of $2.55 on March 29, 2016, the stock has a return potential of about 86%, according to analyst estimates.

Notable recommendations

Among the four firms covering the Vivint Solar stock, Credit Suisse is neutral on the stock, with a price target of $6 assigned on March 16, 2016. However, Goldman Sachs maintains a sell recommendation on the stock with a price target of $3 assigned on March 16, 2016.