China’s Exports Jump: Can the Growth Be Maintained?

According to the General Administration of Customs, China’s exports, in US dollar terms, jumped 11.5% YoY (year-over-year) in March.

April 18 2016, Published 2:55 p.m. ET

Exports and imports

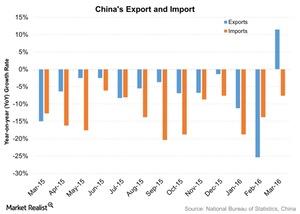

According to the General Administration of Customs, China’s exports, in US dollar terms, jumped 11.5% YoY (year-over-year) in March. This followed a sharp 25.4% decline in February and was the first rise since June 2015. As this rise in exports was mainly due to the Chinese New Year, it may not be sustainable due to the weak global demand. Exports grew partly because of the weakness of the yuan in earlier months.

The solid export data boosted investors’ spirits and hope of the economy stabilizing, subduing the fear of a hard landing. Chinese stocks rose following the release of the upbeat export data.

Meanwhile, imports fell by 7.6% YoY in March, compared with a 13.8% drop in February. Imports were boosted by rising volumes of most major commodities, notably copper and iron ore.

China’s trade surplus came in at $29.9 billion in March, down from $32.6 billion in February. According to a survey conducted by China’s Ministry of Commerce, sluggish global demand, currency fluctuations, and rising labor costs were major concerns.

Impact on mutual funds and ETFs

Rising exports and imports directly impact the revenues and margins of Chinese American depositary receipts for companies such as China Mobile (CHL), CNOOC (CEO), PetroChina (PTR), and Sinopec (SNP). Investors can get exposure to Chinese equity markets through China-focused mutual funds or ETFs.

Mutual funds such as the Clough China Fund – Class A (CHNAX), the Guinness Atkinson China and Hong Kong Fund (ICHKX), and the Eaton Vance Greater China Growth Fund – Class A (EVCGX) and ETFs such as the iShares China Large-Cap ETF (FXI) are invested in the aforementioned Chinese companies. Therefore, their performance is also affected by imports and exports. In the next part of this series, we’ll look at China’s consumer price index and producer price index.