China Mobile Limited

Latest China Mobile Limited News and Updates

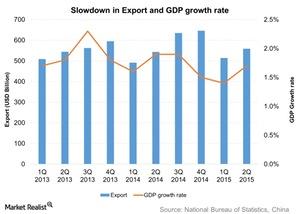

Analyzing China’s Leading Economic Index

China’s Leading Economic Index currently indicates that the country’s economy is facing a downturn. Its LEI remained unchanged at 98.71 points in July 2015.Technology & Communications Why Chinese carriers cutting smartphone subsidies affects Apple

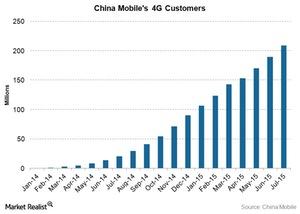

China’s telecom providers, China Mobile (CHL), China Unicom (CHU), and China Telecom (CHA), had started to sell the iPhone 5S at a subsidized price. However, it seems the Chinese government wants to nip this trend in the bud itself.

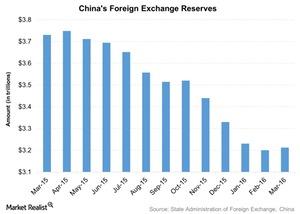

Did China End Its 4-Month Decline in Foreign Reserves in March?

China’s State Administration of Foreign Exchange, or SAFE, released foreign reserve data for March on April 7, 2016. China’s foreign reserves rose $10.3 billion to $3.2 trillion in March.

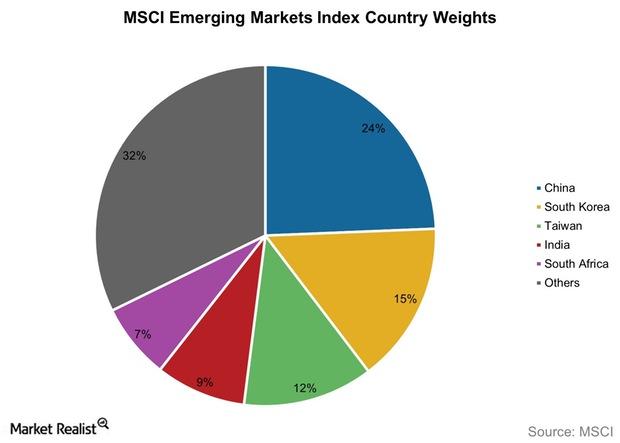

What China Has to Do to Get in the MSCI Emerging Markets Index

There have been significant steps toward the eventual inclusion of China A shares in the MSCI Emerging Markets Index.

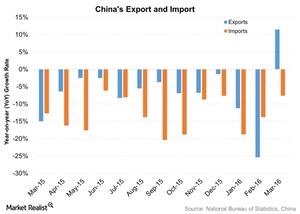

China’s Exports Jump: Can the Growth Be Maintained?

According to the General Administration of Customs, China’s exports, in US dollar terms, jumped 11.5% YoY (year-over-year) in March.

Why Apple Is Optimistic about Its Future Growth Prospects

Although Apple does not provide guidance beyond the next quarter, the management is optimistic about the company’s growth prospects in the long term.

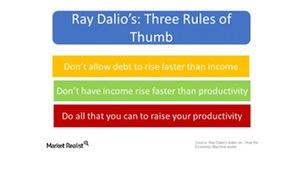

Ray Dalio’s 3 Rules of Thumb and the Road Ahead for China

Chinese policymakers should try to implement Ray Dalio’s three rules of thumb as closely as possible to get the country’s economic growth back on track.

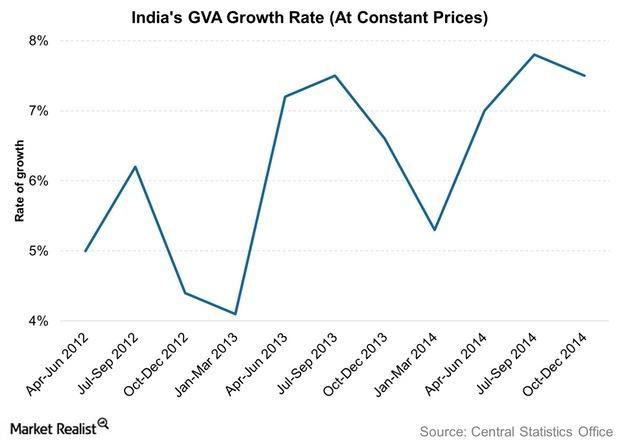

India Now Uses Gross Value Added to Calculate Economic Output

The Indian economy has certainly seen a change since the new government took over. India now uses what is known as GVA (gross value added) to calculate economic output.