Vector Group Declares Dividend of $0.40 per Share

Vector Group (VGR) has a market cap of $2.7 billion. Its stock rose 0.82% to close at $20.97 per share on December 6, 2016.

Dec. 8 2016, Updated 8:06 a.m. ET

Price movement

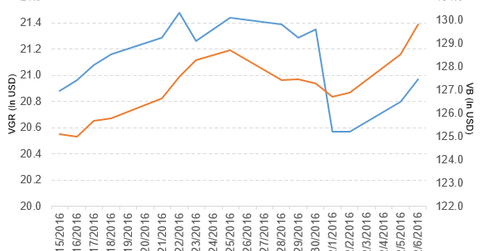

Vector Group (VGR) has a market cap of $2.7 billion. Its stock rose 0.82% to close at $20.97 per share on December 6, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.5%, 2.0%, and -1.5%, respectively, on the same day. VGR is trading 0.41% below its 20-day moving average, 0.53% above its 50-day moving average, and 2.1% above its 200-day moving average.

Related ETF and peers

The Vanguard Small-Cap ETF (VB) invests 0.07% of its holdings in Vector Group. The YTD price movement of VB was 18.5% on December 6.

The market caps of Vector Group’s competitors are as follows:

Vector Group declared dividend

Vector Group has declared a regular quarterly cash dividend of $0.40 per share on its common stock. The dividends will be paid on December 29, 2016, to shareholders of record as of December 21, 2016.

Performance of Vector Group in 3Q16

Vector Group reported 3Q16 total revenues of $459.1 million, a rise of 2.0% compared to total revenues of $449.9 million in 3Q15. Revenue from its e-cigarette and real estate segments fell 0.38% and 98.0%, respectively. Revenue from the tobacco segment rose 3.8% in 3Q16 compared to 3Q15. The company’s operating margin narrowed 30 basis points in 3Q16 compared to the prior-year period.

The company’s net income and EPS (earnings per share) rose to $23.2 million and $0.18, respectively, in 3Q16 compared to $12.5 million and $0.10, respectively, in 3Q15. It reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) and adjusted EPS of $78.9 million and $0.19, respectively, in 3Q16, a rise of 2.2% and 90.0%, respectively, compared to 3Q15.

In the next and final part of this series, we’ll discuss Philip Morris International (PM).