Why Is Nike Focusing on the Direct-To-Consumer Channel?

Nike’s (NKE) DTC (direct-to-consumer) (XLY) (FXD) channel includes sales made online on Nike.com and through its own retail stores.

Nov. 22 2019, Updated 6:37 a.m. ET

Direct-to-consumer channel

Nike’s (NKE) DTC (direct-to-consumer) (XLY) (FXD) channel includes sales made online on Nike.com and through its own retail stores. At the end of fiscal 2015, Nike had about 931 retail locations, expanding its store count by 73 in the year. In contrast, Adidas (ADDYY) (ADS.DE) closed a net total of 191 stores in 2015.

The contribution from the DTC channel has been rising steadily over the past few quarters for Nike, making up 24% of the Nike brand’s revenue in fiscal 1H16, compared with 22% in 1H15. DTC contribution made up 30% of Under Armour’s (UA) revenue in 2015 and 27% of VF Corporation’s (VFC) revenue. NKE makes up 1.8% of the portfolio holdings in the PowerShares DWA Momentum ETF (PDP).

DTC sales drivers

DTC channel sales grew by 15% in 1H16 to $3.7 billion, supported by:

- a 10% increase in same-store sales (currency-neutral terms)

- new store openings

- high growth in the e-commerce channel

Outlook

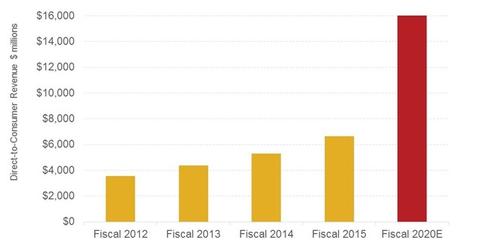

Nike plans for its DTC sales to grow by almost 2.5x in the next five years, from $6.6 billion in fiscal 2015 to $16 billion by fiscal 2020. The company beat its own target of $5 billion in DTC sales by fiscal 2015 by over $1.5 billion.

Nike (NKE) has been using the DTC channel to make brand statements, as well as push sales of premium products. Its control over the channel gives the company greater leeway over pricing, inventory, and merchandising decisions. More importantly, for Nike, DTC channel sales are margin accretive and will help the company achieve its target of a 0.3–0.5 percentage point expansion in its gross margin each year through fiscal 2020. We’ll discuss the profitability expectations for Nike in fiscal 3Q16 in greater detail in part ten of this series. One of the biggest spearheads of DTC sales growth is e-commerce. We’ll discuss this in the next article.