The Earnings Outlook for Nike in Fiscal 4Q16

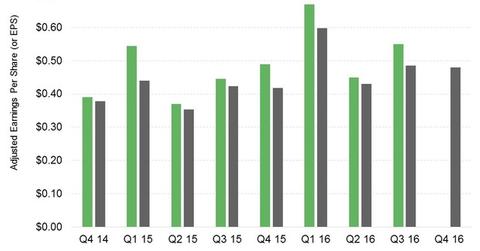

After posting adjusted EPS growth rates exceeding 20% in the first three quarters of fiscal 2016, the earnings expectations for Nike (NKE) in the fourth quarter are modest.

Nov. 22 2019, Updated 5:41 a.m. ET

Earnings per share projections

Nike’s adjusted earnings per share are projected to be $0.48 in the fourth quarter, according to the consensus Wall Street analysts’ estimates. That’s a projected decline of $0.01, or 2.0%, compared to fiscal 3Q15.

However, Nike has beat the consensus Wall Street analyst EPS estimates in its last 15 quarters.

Revised forecasts

Both revenue and EPS expectations for Nike have been dialed down in the last few weeks. At the end of fiscal 3Q16, the company’s fourth quarter EPS was expected to come in at $0.54.

The lowered estimates are in view of bankruptcies of several sporting goods retailers (XRT) (RTH), including The Sports Authority and Sports Chalet. The latter factor resulted in Under Armour (UA) slightly revising down its earlier revenue figure for 2016.

Nike’s largest wholesale partners, Foot Locker (FL) and Dick’s Sporting Goods (DKS), also reported weaker-than-expected same-store sales growth in the last quarter.[1. ended April 30, 2016] Comps growth for FL came in at 2.9%, while DKS reported same-store sales of 0.5%.

Share repurchases

Some upside in Nike’s EPS in the fourth quarter could be provided by share buybacks (PKW). The company is cash-rich and has authorized a new $12 billion four-year share repurchase program in November 2015.

In the first nine months of fiscal 2016, Nike spent $2.8 billion on repurchasing 46.4 million shares. Nike plans to use its free cash flow, as well as possibly taking recourse to debt markets, for funding future share repurchases.