Marriott–Starwood Merger Synergies: The World’s Largest Hotel Chain

The Marriott–Starwood deal holds immense significance for Marriott International because the combined entity of Marriott International and Starwood Hotels and Resorts Worldwide would create the world’s largest lodging company.

March 29 2016, Published 3:11 p.m. ET

Importance for Marriott

The Marriott–Starwood deal holds immense significance for Marriott International because the combined entity of Marriott International and Starwood Hotels and Resorts Worldwide would create the world’s largest lodging company.

If the deal goes through, the new merged group would own more than 5,500 hotels worldwide, with about 30 distinctive chains and more than 1.1 million guest rooms worldwide. This would mean wider choices for guests as they earn loyalty points.

Importance for the hotel industry

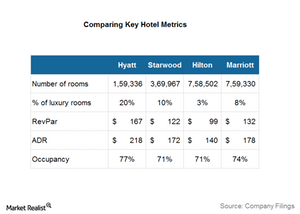

This deal could potentially kick off a consolidation phase in the hospitality industry. Other brands could see additional mergers and acquisition activities in order to hold off fiercer competition. Not only would it affect larger peers like Hyatt Hotels Corporation (H) and InterContinental Hotels Group (IHG), the upcoming alternative lodging options like HomeAway (AWAY) and Airbnb could look out for merger and acquisition activity.

It would also give the combined entity an edge in facing Chinese firms with huge holdings. Even though the bid is lower, in the long term this deal would have better prospects due to the higher synergies, as both companies share the same businesses.

Investors can gain exposure to the hotel sector by investing in the iShares Russell 1000 Growth ETF (IWF), which invests approximately 3% in the hotel sector. The ETF invests 0.14% in Marriott International (MAR), 0.09% in Wyndham (WYN), and 0.12% in both Hilton Worldwide Holdings (HLT) and Starwood Hotels (HOT).