What Are Harley-Davidson’s Valuation Multiples?

As of March 29, 2016, Harley-Davidson’s forward EV/EBITDA multiple is 11x for the next 12 months.

April 20 2016, Updated 4:04 p.m. ET

Harley-Davidson’s valuation methods

There are many different valuation methods available for valuing automakers such as Harley-Davidson (HOG). We believe that investors should use a combination of discounted cash flow and valuation multiples to value the company. First, let’s use a relative valuation method based on Harley-Davidson’s valuation multiples. Then we’ll move on to the DCF (discount cash flow) valuation method.

Valuation multiples

Valuation multiples are widely used in the auto industry (VCR) to compare companies. However, it is important to understand this comparison can only be done between companies that are similar in nature in terms of business, size, or financials. In the case of Harley-Davidson, no other automakers are similar enough to the company’s business. Therefore, we’ll also look at the valuation multiples of some Japanese motorcycle makers to compare with Harley’s multiples.

The EV/EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple is an important relative valuation multiple. It’s generally used for capital-intensive industries such as the auto industry.

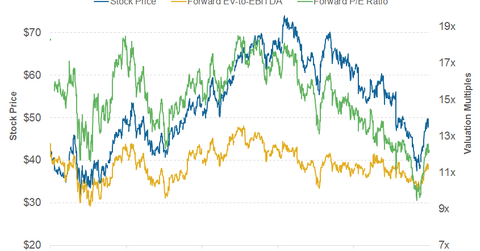

As of March 29, 2016, Harley-Davidson’s forward EV/EBITDA multiple is 11x for the next 12 months. This is significantly higher than the EV/EBITDA of Japanese motorbike makers Yamaha and Kawasaki with 4.1x and 6.4x, respectively. Likewise, Harley-Davidson’s forward PE ratio, based on its earnings forecast for the next 12 months, stands at 12.4x, higher than Yamaha’s 7.6x and Kawasaki’s 9.3x.

These forward valuation multiples are calculated based on expected values of the denominator after a year. As you can see in the chart above, General Motors’ valuation multiples are currently in a downtrend. This could be because of the concern that US auto sales may have already peaked last year.

The dominance in the premium motorbike segment and high brand value of Harley-Davidson Motor Company is one of the biggest factors behind its valuation multiples trading much higher in comparison to other automakers.

Among large carmakers, Toyota Motors’ (TM) valuation multiples typically trade much higher than those of major US automakers including General Motors (GM) and Ford (F). This is partially because Toyota has a strong presence in the premium vehicle segment, which yields higher margins than mass-marketed vehicles.

Discounted cash flow method

Harley Davidson’s business model is mature enough to predict its cash flows. This makes the DCF method appropriate in valuing a company such as Harley-Davidson unlike other fairly new tech companies such as Google, Facebook, and electric vehicle maker Tesla (TSLA).

However, investors must keep in mind that the automotive industry is cyclical in nature. Therefore, it could be a challenge when using the DCF method to value other automotive companies that are highly sensitive to this auto industry cycle.

Continue to the next article to understand the factors that may affect Harley-Davidson’s valuation multiples.