Decoding Roche’s Performance on EV-to-EBITDA Basis

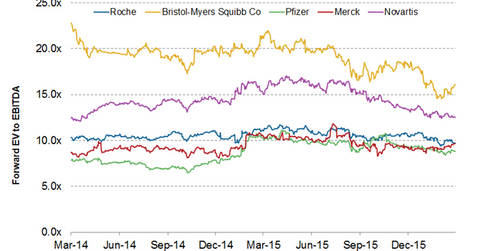

As of March 8, Roche Holding was trading at a forward EV-to-EBITDA multiple of 9.73x—a discount compared to Bristol-Myers Squibb’s 16.09x.

March 14 2016, Published 5:40 p.m. ET

Is Roche trading at a discount?

As of March 8, 2016, Roche Holding (RHHBY) was trading at a forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple of 9.73x. The company has been trading at a discount when compared with the forward EV-to-EBITDA multiple of Bristol-Myers Squibb’s (BMY) 16.09x and Novartis’s (NVS) 12.51x. Pfizer (PFE) and Merck & Company (MRK), by comparison, were trading at EV-to-EBITDA multiples of 8.86x and 9.65x, respectively.

Comparing the industry’s operating margin

As of March 8, the median and average operating margins for the industry stood at about 18.2% and about 23.6%, respectively. Roche’s operating margin of around 28.7% is higher than the industry standard. During 2015, the company reported stable but slightly improved operating margins. It further expects margin improvement in 2016.

The average forward EV-to-EBITDA multiple for Roche was ~10.6x over the past two years. The enterprise value of the company has ranged from 9x–11.1x of its forward EBITDA, and the company’s current forward multiple of 9.73x seems to be at the lower end of this range.

The pharmaceutical portfolio of the company leans heavily toward oncology drugs. Generally, oncology drugs offer higher margins because they are priced higher. Notably, Bristol is a leader in immune-oncology market and has been trading at a premium against Roche. But positive outcomes for Roche’s late-stage drugs Perjeta, Gazyva, and Atezolizumab might result in a rise in Roche’s multiple.

Why EV-to-EBITDA?

Biotechnology is capital-intensive in nature—these companies are highly leveraged—and so the EV-to-EBITDA multiple represents the best comparison metric, because EV is neutral with regard to capital structure, whereas EBITDA excludes non-operating components.

Still, it’s risky to directly invest in any equity, but risk-averse investors always have the option of ETFs like the Vanguard FTSE All-World Ex-US Index Fund (VEU), which has 1.03% of its total holdings in Roche.