Can the Samsonite-Tumi Merger Get Antitrust Approval?

Samsonite will need to file for merger approval under the Hart-Scott-Rodino Antitrust Improvements Act. The companies will need to file for Canadian antitrust approval.

March 9 2016, Published 7:55 a.m. ET

Regulatory approvals

With most mergers, the rate of return is driven by the time it takes to finalize the transaction. In the case of the Samsonite-Tumi (TUMI) merger, several conditions must be met before the transaction can close.

Antitrust requirement

Samsonite will need to file for merger approval under the Hart-Scott-Rodino Antitrust Improvements Act. The companies will also need to file for Canadian antitrust approval.

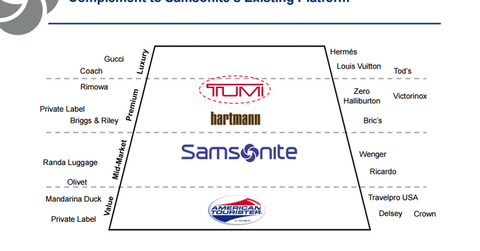

Professional arbitrageurs usually go to the respective companies’ 10K to get a read on antitrust and to see if the companies name each other as competitors. In its latest 10K, Tumi mentions Samsonite as one of its competitors. However, it names several large competitors including Coach (COH), Burberry (BURBY), Gucci, Prada, and Louis Vuitton, among others. The question for regulators is how granular they want to get. Market definition is going to be the key.

That said, the marketplace looks extremely competitive. Companies like Coach and Burberry are large and powerful competitors. While there’s always the possibility of a second request, it doesn’t appear to be an insurmountable problem.

Best efforts

The companies agree to use reasonable best efforts to obtain antitrust approval and to cooperate with the antitrust authorities and each other to secure the deal. However, they aren’t required to make any divestitures or behavioral changes that would result in a loss of more than $50 million in 2015 revenue.

Other merger arbitrage resources

Other important merger spreads include the Cigna (CI)-Anthem (ANTM) deal. It’s slated to close in 2H16. Another important transaction is Apollo’s purchase of ADT (ADT). For a primer on risk arbitrage investing, read Merger arbitrage must-knows: A key guide for investors.

Investors who are interested in trading in the consumer discretionary sector should look at the Vanguard Consumer Discretionary ETF (VCR).