What’s the Rationale for the ITC-Fortis Merger?

Fortis (FRTSF) is buying ITC (ITC) in the largest Canadian purchase of a US utility. Fortis intends to sell a 19% stake in order to help finance the transaction.

Nov. 20 2020, Updated 11:29 a.m. ET

Large deal in the power transmission sector

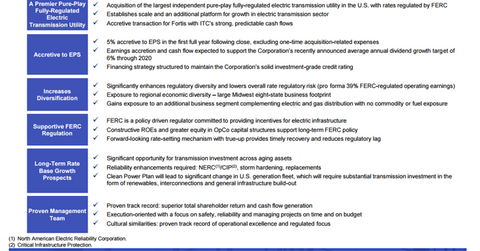

Fortis (FRTSF) is buying ITC (ITC) in the largest Canadian purchase of a US utility. ITC owns ~15,200 miles or transmission lines mainly in the Midwest. This deal is more about growth than it is about cost control.

Fortis intends to sell a 19% stake in order to help finance the transaction.

Comments from management

“Fortis has grown its business through strategic acquisitions that have contributed to strong organic growth over the past decade. Our performance in 2015 is a clear demonstration of the success of this strategy,” says Mr. Barry Perry, President and Chief Executive Officer of Fortis. “The acquisition of ITC – a premier pure-play transmission utility – is a continuation of this growth strategy. ITC not only further strengthens and diversifies our business, but it also accelerates our growth.”

“From the very beginning of ITC, we have been focused on creating meaningful value for all stakeholders, including customers, investors and employees, by becoming the leading electric transmission company in the U.S.,” says Joseph L. Welch, Chairman, President and CEO of ITC. “Fortis is an outstanding company with a proven track record of successfully acquiring and managing U.S. based utilities in a decentralized manner. This transaction accomplishes our objectives by better positioning the company to have a higher level of focus on pursuing our long-term strategy of investing in transmission opportunities to improve reliability, expand access to power markets and allow new generating resources to interconnect to transmission systems and lower the overall cost of delivered energy for customers.”

Expected synergies and pro forma financials

The companies anticipate that they will generate ~5% earnings accretion in the first year after the merger. They didn’t mention specific synergy estimates in the press release.

Other merger arbitrage resources

The Cigna (CI) and Anthem (ANTM) merger is expected to close by mid-2016. Another important deal is the Humana (HUM) and Aetna (AET) transaction. It’s slated to close in late 2016. For a primer on risk arbitrage investing, read Merger arbitrage must-knows: A key guide for investors.

Investors who are interested in trading in the utilities space should look at the S&P SPDR Utilities ETF (XLU).