Treasury Yields Could Stay Low: Here’s Why

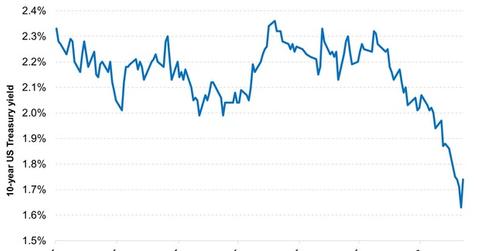

The ten-year Treasury (IEF) yield has plunged in recent weeks. It dipped from 2.3% at the start of this year to ~1.6% currently, in a risk-off trade.

Feb. 25 2016, Updated 10:06 a.m. ET

In today’s volatile environment, it’s a good idea to consider building hedges to existing stock and credit allocations with the help of “safe-haven” bonds that are more sensitive to interest rates. In other words, when markets are volatile and there are worries about a recession, interest rate exposure can help offset credit risk in a fixed income portfolio.

The traditional way to do this would be to add exposure to nominal U.S. Treasuries, perhaps the safest of the “safe-haven” bonds, as they’re backed by full faith and credit of the U.S. government. Yet Treasury yields are still testing all-time low levels, and the Federal Reserve (or Fed)’s rate normalization cycle is likely to continue, albeit very slowly. In short, these bonds remain both expensive (remember that bond prices and yields move in opposite directions) and vulnerable.

Market Realist – Treasury yields still trending lower

As we mentioned in Part 2 of this series, investors usually resort to Treasuries (TLH) to cushion the fall in the equity side of their portfolio.

However, as the graph above shows, the ten-year Treasury (IEF) yield has plunged in recent weeks. It dipped from 2.3% at the start of this year to ~1.6% currently, in a risk-off trade. Global equities (ACWI) have been battered, and some markets—like China (FXI)—are in bear market territory.

The Shanghai Composite Index is down 19.0% year-to-date (or YTD). Meanwhile, the S&P 500 index (IVV) is down 5.7% YTD despite the recent comeback.

Even if the Fed hikes rates, long-dated Treasuries (UBT) are likely to stay low, like they did when the Fed hiked rates in December. This is because global sovereign yields, especially those in Europe and Japan, remain at extremely low levels. So there’s high foreign demand for US Treasuries while supply remains thin.

As a result, long-dated Treasury yields will likely remain at unattractive levels. So you may consider other classes within fixed income to cushion your equity portfolio. We’ll take a look at some options in the next part of this series.