Saudi Arabia Is Depleting Its Foreign Exchange Reserves

It’s been more than a year since Saudi Arabia has had a new king, and what an eventful year for the country under his leadership!

Feb. 17 2016, Published 5:16 p.m. ET

Saudi Arabia, which enjoyed a fiscal surplus balance of +30 percent of gross domestic product (or GDP) in 2009, had a -21 percent deficit of GDP in 2015, as estimated by the International Monetary Fund (or IMF). Saudis need financing for the war in Yemen and a generous system of state handouts (government spending cuts have limits, especially when some 90 percent of the population is employed by the government).

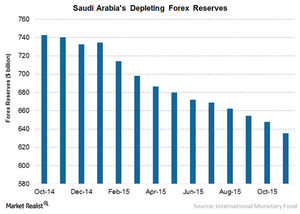

This “more going out than coming in” pattern is supported by the decline of the country’s foreign exchange reserves, still the highest in the region, to $640 billion as of the end of the 2015 third quarter, from a peak of $740 billion in 2014, according to data accessible via Bloomberg.

Market Realist – Saudi is burning through its forex reserves to support domestic finances and regional ascendancy

It’s been more than a year since Saudi Arabia has had a new king, and what an eventful year for the country under his leadership! The most prominent shift occurred in the country’s foreign policy. It adopted a more aggressive stance toward regional adversaries. The country sharpened its air offensive against rebels in Yemen, which are backed by Iran. Mounting security concerns led to a rise in military spending recently as the United States (IVV) (AGG) loses interest in the region. The country’s defense budget grew at a rate of 19% per year since 2011 compared to 14% over the last decade.

The stress on public finances was exacerbated by the government’s decision to dole out government employees and pensioners a two-month bonus soon after the king took the throne. This largesse is estimated to have cost the government around $32 billion.

To maintain such high spending, the country had no other option but to burn its huge foreign exchange reserves. Its public finances have already been hurt badly by the drastic fall in crude oil (GSG) prices. The kingdom’s ambition to play a larger role in the region, without much involvement from the United States and Europe (EWG) (EWU), means its spending is likely to accelerate. Saudi Arabia has already announced a budget deficit of $87 billion for fiscal 2016.