What Are Bridgewater’s Largest Holdings?

Ray Dalio’s Bridgewater Associates is a prominent hedge fund management firm. Previously, the firm held an optimistic view about emerging markets (EDC) (IEMG).

Jan. 27 2017, Updated 9:41 a.m. ET

Bridgewater Associates’ holdings

Ray Dalio’s Bridgewater Associates is a prominent hedge fund management firm. Previously, the firm held an optimistic view about emerging markets (EDC) (IEMG). In 1Q16, Bridgewater Associates had 32.8% of its holdings invested in the Vanguard FTSE Emerging Markets ETF (VWO) and another 18.6% in the iShares MSCI Emerging Markets (EEM). Thus, Bridgewater’s sizable holding in emerging markets reflected its optimistic view.

As of 3Q16, Bridgewater Associates had reduced some of its holdings in the Vanguard FTSE Emerging Markets ETF (VWO) as compared to 1Q16. It had 29.8% of its holdings in VWO as of September 30, 2016. According to the institutional ownership report, the firm is the largest investor in the Vanguard FTSE Emerging Markets ETF (VWO). It held nearly 80.4 million shares as of September 30, 2016.

The stronger US dollar (UUP) is a threat to emerging economies. In the past year, the US dollar and emerging economies have moved in opposite directions. The dollar is getting stronger by the day due to economic growth and expectations of interest rate hikes.

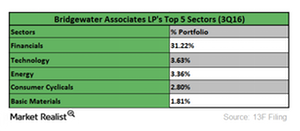

Sectoral allocation

Bridgewater Associates’ highest sectoral allocation is in the financial sector (XLF). It holds nearly 31.2% of its portfolio in the financial sector. The possible abolition of the Dodd-Frank Wall Street Reform Act and expectations about the Fed’s gradual rate hike process are making financial stocks attractive. The fund’s second-largest sectoral allocation is the technology sector (XLK).

In the next part of this series, we’ll analyze Ray Dalio’s views on the stock rally and the bond sell-off.