India’s Economic Growth in GVA Terms: What Does the RBI Expect?

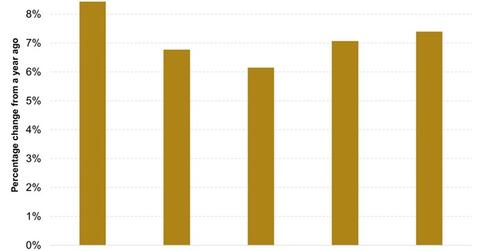

For financial year 2016–2017, the RBI forecasts the GVA growth at a 7.6% pace. This assumes that there aren’t any significant headwinds.

Nov. 20 2020, Updated 3:52 p.m. ET

A brief note about GVA

India’s economic growth is measured in GVA (gross value added) terms. Although the GDP (gross domestic product) is still calculated, when we refer to India’s economic growth, we’re referring to the percentage change in the GVA. The relationship between GDP and GVA is:

GDP = GVA + taxes on products – subsidies on products

The base year for calculating India’s GVA is 2011–2012. It changed from 2004–2005 used earlier. In India, a fiscal year begins in April and ends in March the following year. As a result, July–September is the second quarter for India.

India’s economic growth

In the last part, we discussed how the RBI (Reserve Bank of India) said that economic activity had been hampered by slower agriculture and industrial sectors. While presenting its projections for GVA, the RBI said that prospects for sowing in the rabi crop season are improving. It also said that a rise in profitability due to a fall in costs may help offset the downward pressure on industrial activity due to weak exports. With these and other aspects in mind, the RBI expected GVA growth for financial year 2015–2016 to remain unchanged at 7.4% with a downward bias.

For financial year 2016–2017, the RBI forecasts the GVA growth at a 7.6% pace. This assumes that there aren’t any significant headwinds. This forecast is based on the assumption that monsoon rains will return to normal after two years of deficient rainfall in the season. However, export growth, weak domestic private investment, and excess capacity in the industry, apart from a few other factors, could cap India’s GVA growth.

India’s economic growth and monetary policy

The RBI kept the repo rate unchanged. It called its monetary policy stance “accommodative.” If it reduced the repo rate again, it could have spurred economic growth more, theoretically. However, it would have resulted in a rise in inflation. This would have forced it to reverse its reduction and hike key rates again.

India is expected to outpace China in terms of economic growth in 2016 by multi-lateral agencies like the International Monetary Fund and the World Bank. Exports remain a problem, but it’s primarily due to a slowdown in overseas demand. Considering how its BRICS appears, India looks to be in a strong position, especially since it continues to benefit from falling energy prices. If you want to diversify your investment and emerging markets are on your mind, you can invest in mutual funds like the Wasatch Emerging India Fund (WAINX) and the Franklin India Growth Fund – Class A (FINGX), among other funds highlighted in this review. They provide you with exposure to blue chip Indian companies like ICICI Bank (IBN), HDFC Bank (HDB), and Infosys (INFY).

The RBI will meet on April 5, 2016. We’ll analyze the developments. For the latest updates, visit Market Realist’s Mutual Funds page.