ETF Exposure in the Offshore Drilling Space

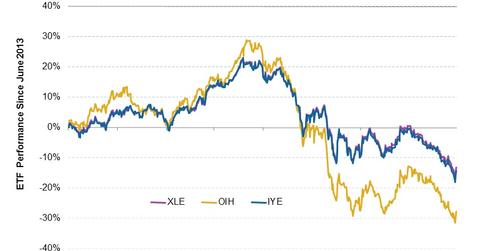

Among the biggest ETFs in the offshore drilling space, investors can choose between ETFs like OIH, XLE, and IYE for exposure to offshore drilling.

Feb. 8 2016, Updated 5:06 p.m. ET

How ETFs work

An ETF, or exchange-traded fund, is a marketable security traded on the stock exchange. ETFs can be bought and sold throughout the day, and ETFs either track an index, a commodity, bonds, or a basket of assets. ETFs are thus an attractive option for investors interested in diversified exposure to various stocks because the performance of a given ETF is closely related to the stocks the fund invests in.

Among the biggest ETFs in the offshore drilling space, investors can choose between ETFs like OIH, XLE, and IYE—just to name a few—for exposure to offshore drilling companies.

The VanEck Vectors Oil Services (OIH)

This ETF tracks an index of the twenty-five largest US-listed oil services companies. OIH is heavily weighted toward the oil and gas drilling industry, with 24.3% position in this industry. Among the other ETFs we’ve discussed here, OIH has the maximum exposure to oil drilling companies. Transocean (RIG), Seadrill (SDRL), and Noble Corporation (NE) have a high allocation in this ETF among the oil drilling companies.

The Energy Select SPDR (XLE)

This ETF tracks US energy companies in the S&P 500. XLE has just over 1.6% of its holdings in oil and gas drilling companies, but XLE is famous for being the largest, cheapest, and most liquid US energy ETF. It has an expense ratio of 0.15%, compared to OIH and IYE, which have expense ratios of 0.35% and 0.45%, respectively.

The iShares US Energy (IYE)

This ETF tracks US Energy companies as classified by Dow Jones. This ETF has the broadest offerings, with a position in 92 stocks. Oil and gas drilling stocks have over 2.1% allocation in the total holdings of the ETF. IYE’s top three holdings include Exxon Mobil Corporation (XOM), Chevron Corporation (CVX), and Schlumberger (SLB), which together make up 40% of the fund’s total holdings. Interestingly, for the past two years, IYE and XLE have given almost the exact same returns.

In the next and final part of this series, we’ll talk valuation multiples across the offshore drilling industry.