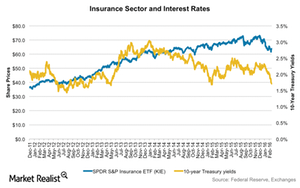

The Effect of an Interest Rate Reversal on Insurance Companies

Interest rates are a key performance driver for life insurance companies. They affect their margins, hedging costs, and product sales.

Feb. 18 2016, Published 9:25 a.m. ET

Margin pressures would increase if NIRP is implemented

In this part of the series, we’ll see how interest rates affect the profitability of insurance companies. Interest rates are a key performance driver for life insurance companies. They affect their margins, hedging costs, and product sales. Low interest rates directly affect margins of insurers, as they price their products using expected long-term average rates.

Insurance companies and pension funds are hurt by a negative interest rate policy (or NIRP). This is because insurance companies invest their premiums in corporate and government fixed income instruments. They earn investment income from the coupons and yields on these instruments, which are linked to the Fed funds rates and bank interest rates.

If the Fed did adopt NIRP, investment income of these companies would turn negative. This is because yields and coupons on bonds decline when rates turn negative. So NIRP pressures the margins of insurers.

Impact on insurance companies

NIRP (TLT) has adverse effects on stocks of insurance companies. If the Federal Reserve decides to adopt NIRP, we could see shares of insurance companies correct further. This includes stocks of large insurers such as Prudential Financial (PRU), Assurant (AIZ), and Ace (ACE). It would also lead to a downfall of ETFs tracking the insurance space such as the SPDR S&P Insurance ETF (KIE).