ACE Ltd

Latest ACE Ltd News and Updates

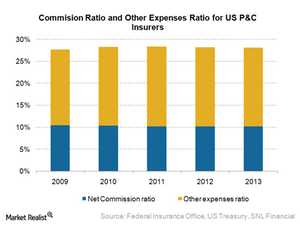

How cost structures and distribution channels impact profit

As customers use Internet-based aggregators to purchase insurance policies, insurers use online sales to interact directly with customers and reduce costs.

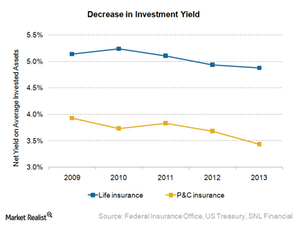

How investment income drives profit

The impact of interest rate movements is lower in the P&C segment, as their products can be repriced annually to keep in line with interest rate movements.

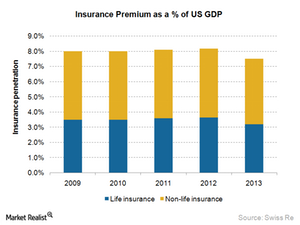

How key drivers impact insurance sales

For P&C insurers such as AIG and ACE, various mandatory requirements may drive sales of vehicle, workers’ compensation, and homeowners insurance.

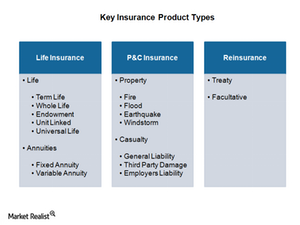

Life insurance, P&C insurance, and reinsurance

P&C products have commoditized characteristics, resulting in sharp competition in the market and business cycles. AIG and ACE are key players in this space.

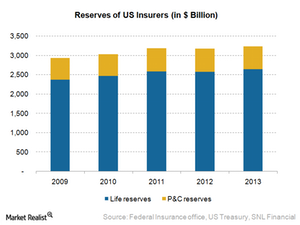

Making sense of an insurer’s liabilities

Policyholder liabilities, or policyholder reserves, represent the future claims that may arise for the pool of policies the insurer writes.

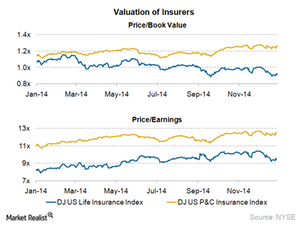

How valuation of insurance companies works

Financial market movements not only impact income from invested assets, but also the value of assets carried at fair value on an insurer’s balance sheet.

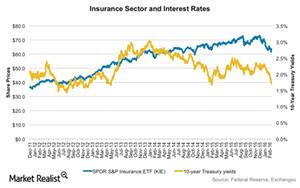

The Effect of an Interest Rate Reversal on Insurance Companies

Interest rates are a key performance driver for life insurance companies. They affect their margins, hedging costs, and product sales.

Rising Interest Rates, Banks, and Insurance Companies

Banking stocks are expected to benefit from higher interest rates, but not immediately. Also, rising interest rates would be countered by higher existing liquidity.

What Is the Rationale for the ACE–Chubb Merger?

The biggest rationale for the ACE–Chubb merger is the potential for cost-cutting. By combining with Chubb, ACE Limited is creating a leading player in property and casualty insurance.

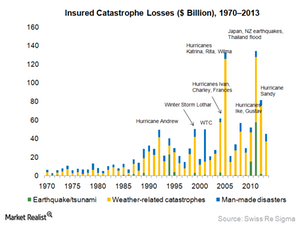

A Closer Look at the Costliest Catastrophes

Hurricanes Sandy, Ike, and Andrew remain near the top of the list of the costliest catastrophes in terms of insured losses.

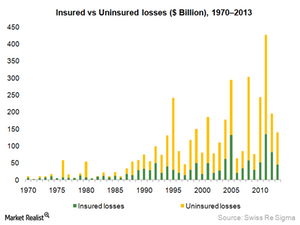

Making Sense of Economic and Insured Losses

Insured losses are the ones that impact the profitability of insurance companies.

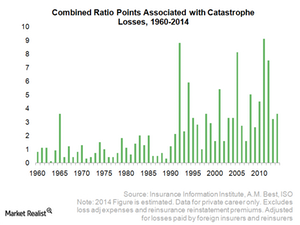

How Catastrophes Impact a P&C Insurer’s Combined Ratio

The percentage points for catastrophe losses in the combined ratio have increased in recent years.

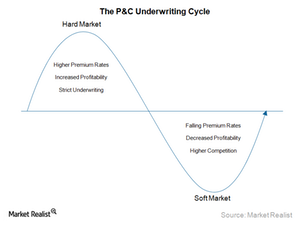

How Underwriting Cycles Impact the Top Line and the Bottom Line

The underwriting cycle moves between hard and soft market conditions, which have different sets of characteristics that determine the profitability of the insurance industry.

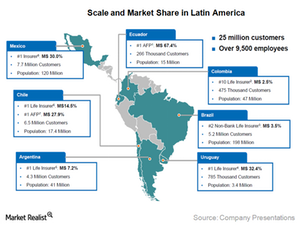

MetLife is the largest player in Latin America

MetLife plans to grow its retail and group business in Latin America, capitalizing on the growing middle class, affluent class, and corporate needs.