Can European Indexes Rally in the Current Global Turmoil?

In the current global scenario, the possibility of further devaluation of the Chinese yuan is a major concern for global equity markets. The Chinese PMI data released on January 31, 2016, indicated a slowdown in the Chinese economy.

Nov. 20 2020, Updated 3:59 p.m. ET

What is concerning the investors?

The rally in the European equity market can be short-lived because of the risk from overseas, as well as from the Eurozone’s internal factors. To date, the European market has not been able to return to the levels seen in the beginning of February 2016.

In the current global scenario, the possibility of further devaluation of the Chinese yuan is a major concern for global equity markets. The Chinese PMI data released on January 31, 2016, indicated a slowdown in the Chinese economy (YINN). After that, a major global market sell-off started, which continued until the week ended February 12.

[marketrealist-chart id=1056887]

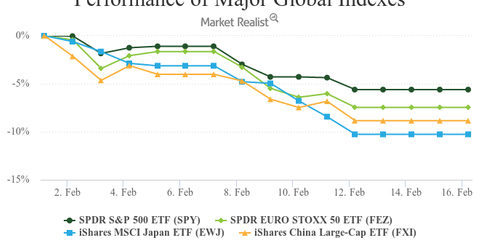

From February 1–February 11, 2016, the S&P 500 Index has fallen about 5.6%, the United Kingdom FTSE 100 (EWU) has fallen about 5.8%, the Germany DAX index has fallen about 10.3%, and the Japanese Nikkei 225 (EWJ) has fallen by 12.3%.

Still, the global equity markets do not have a clear vision of corporate earnings, and the global manufacturing slowdown is still weighing on the markets. Riskier assets like equities may be more volatile due to the above reasons. The above graph shows the performance of major global indexes since February 1, 2016.

Where to look in the Eurozone as interest rates drop

To propel the Eurozone economy, the ECB is pushing further quantitative easing (or QE) measures. However, investors must understand that QE also impacts the currency of the Eurozone. It directly implies that if there will be higher quantitative easing, the Euro could further depreciate. This could increase the export competitiveness of the Eurozone, specifically Germany (EWG).

The powerhouse of the Eurozone, Germany is the major exporting economy stands to benefit from the above action. The country’s major automobile and service exporting companies of Germany such as Volkswagen (VLKAY), Daimler (DDAIF), and SAP (SAP) could benefit from this step.

To learn more, please read Why Deflation Is Not Good for Your Returns.