Why Most Analysts Rate Chevron a ‘Buy’

Analyst ratings for Chevron Chevron (CVX) has been rated by 25 analysts. Of the total, 17 analysts have given “buy” or “strong buy” ratings, eight have given “hold” ratings, and none have given “sell” or “strong sell” ratings on the stock. These ratings have improved from March 2016, when Chevron had fewer “buy” ratings, more […]

March 14 2017, Updated 10:37 a.m. ET

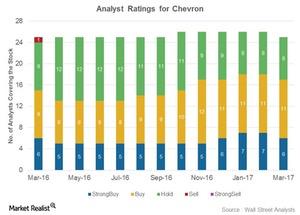

Analyst ratings for Chevron

Chevron (CVX) has been rated by 25 analysts. Of the total, 17 analysts have given “buy” or “strong buy” ratings, eight have given “hold” ratings, and none have given “sell” or “strong sell” ratings on the stock.

These ratings have improved from March 2016, when Chevron had fewer “buy” ratings, more “hold” ratings, and one “sell” rating. In March 2017, Chevron saw cuts and raises to its target price from various investment banking firms.

UBS raised Chevron’s target price from $108 to $114, and has a “neutral” rating on the stock. Jefferies raised its target price from $141 to $147 per share. Independent Research, which has a “buy” rating on the stock, raised Chevron’s target price from $130 to $131. However, Goldman Sachs cut its target price for Chevron from $127 to $126.

Chevron’s mean target price of $126 per share is 15% above its current market price. Peers Royal Dutch Shell (RDS.A), ExxonMobil (XOM), and BP (BP) have been rated as “buy” by 92%, 23%, and 42% of analysts, respectively. Global players Statoil (STO), Petrobras (PBR), and YPF (YPF) have been rated as “buy” by 60%, 28%, and 77% of analysts, respectively. If you’re looking for exposure to large companies, you could consider the SPDR S&P 500 ETF (SPY). The ETF has ~7% exposure to energy sector stocks, including XOM and CVX.

Why most analysts rate Chevron as a “buy”

Chevron (CVX) has adopted a strategy of optimizing capex, exiting non-core assets, and cutting costs. Also, capital-intensive projects that required massive outlays, such as Gorgon, have started production. Wheatstone is expected to begin by mid-2017. Chevron’s substantial investments over the past few years are now yielding results. With the startup of growth projects, Chevron is set to take advantage of any rise in oil prices.

Also, Chevron is stable in regards to leverage, providing the company financial strength and flexibility. Going forward, with Chevron’s strategy and new projects yielding results and higher oil prices, Chevron is likely to witness steep earnings. It’s no wonder most analysts rate Chevron a “buy.”