What Is Verizon’s Value Proposition?

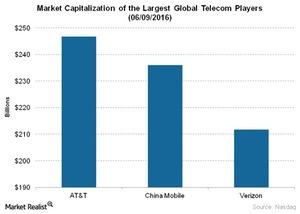

As of June 9, 2016, Verizon is the third-largest global telecom company by market capitalization.

June 15 2016, Updated 11:05 a.m. ET

Verizon’s size among telecom majors

In the earlier parts of the series, we learned about some updates from Verizon (VZ) from the recent Bank of America Merrill Lynch Global Telecom & Media Conference. Fran Shammo, the telecom company’s CFO and executive vice president, participated in that conference. Now, we’ll look at Verizon’s value proposition among select global telecom titans.

As of June 9, 2016, Verizon is the third-largest global telecom company by market capitalization. The biggest global telecom company is AT&T (T) as of the same date, followed by China Mobile (CHL).

Verizon’s earnings multiples

Now let’s look at Verizon’s valuation multiple in comparison to a few other global telecom players. Verizon was trading at a current year PE (price-to-earnings) multiple of ~13.2x on June 9, 2016. This figure is lower than the comparable PE multiple for AT&T of ~14x.

In the global telecom space, Telefonica (TEF) and Deutsche Telekom (DTEGY) had PE multiples of ~14.4x and ~17x, respectively, as of June 9, 2016.

Enterprise value multiples for Verizon and some global peers

Now let’s move to Verizon’s EV (or enterprise value) multiples. The carrier’s current year EV/EBITDA (earnings before interest, tax, depreciation, and amortization) multiple was ~7x as of June 9, 2016, which was higher than AT&T’s multiple of ~6.8x.

Among the global telecom majors, Vodafone (VOD) and Telefonica had multiples of ~7.4x and ~7.5x, respectively, as of June 9, 2016.

Instead of direct exposure to Verizon’s stock, you can consider diversified exposure to the company by investing in the SPDR Dow Jones Industrial Average ETF (DIA). The telecom giant made up ~2% of the ETF at the end of May 2016.