DTE Energy Co.

Latest DTE Energy Co. News and Updates

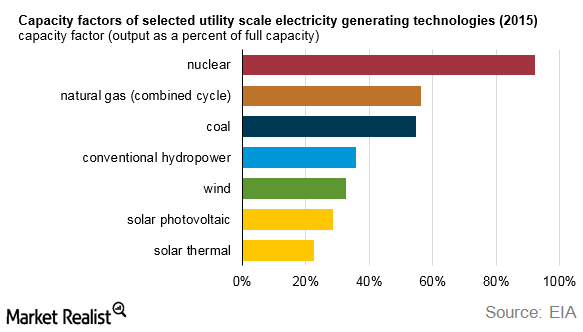

Energy Sources: Capacity Factor and Capacity Additions

Capacity additions in wind power have been quite volatile over the past few years due to uncertainty over tax incentive policies.

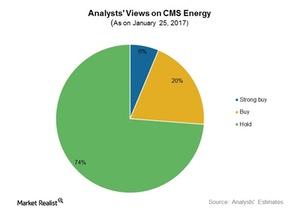

Inside CMS Energy’s Price Targets ahead of 4Q16 Results

CMS Energy (CMS) has a mean price target of $44.33 for the coming year. This implies an estimated upside of 5.6%.

Why Is Xcel Energy’s Rising Debt So Concerning?

At the end of the fourth quarter of 2015, Xcel Energy’s total debt stood at $13 billion. Its debt-to-equity ratio was 1.3x, and its debt-to-capitalization ratio was 0.6x.