Gold Miners’ Geographic Exposure Impacts Growth Prospects

While gold miners try to limit their exposure to safe jurisdictions, it’s important to look at geographic exposure and its implications on their prospects.

Jan. 12 2016, Published 9:27 a.m. ET

Importance of geographical exposure

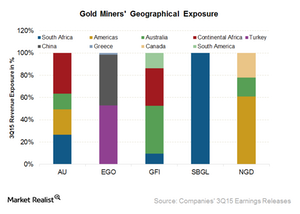

While gold miners (GDX) are trying hard to limit their exposure to safe jurisdictions, it’s important to look at their geographic exposure and the implications it could have on their prospects. Operations in safe jurisdictions provide stability to the overall earnings profile with fewer interruptions. The United States, Canada, and Australia are usually considered safer jurisdictions.

Operations in safe jurisdictions

New Gold (NGD) has an attractive geopolitical profile. All its assets are in the top five mining jurisdictions of Canada, Australia, the United States, Chile, and Mexico. These jurisdictions have good infrastructure and are politically stable.

Higher geopolitical risk

Sibanye Gold (SBGL) has all its mining assets in South Africa. Gold mining costs are higher in South Africa as compared to other geographies. The wage negotiations have also been ongoing for quite some time without full resolution. Unreliable electricity and drastic rate rises are also commonplace. It’s important to note that Sibanye is trying to become self-sufficient in power. On the other hand, the weakness in the South African rand as compared to the US dollar (UUP) has provided strong currency tailwinds to the company.

AngloGold Ashanti (AU) has close to 50% of its reserves and resources in South Africa and faces challenges that are similar to those faced by other South African miners such as Sibanye.

Eldorado Gold’s (EGO) development projects have a geopolitical risk that’s higher than average, with reserves spread across Greece, Turkey, and China. In August 2015, Greece’s energy ministry revoked the technical studies for Eldorado Gold’s (EGO) Skouries and Olympias projects. While Greece currently forms 2% of EGO’s total production, development projects there could make up ~20% of EGO’s production profile once fully ramped up. In October 2015, a temporary injunction relief was awarded to EGO. However, a more long-term solution would be constructive for share price stability.

Gold Fields (GFI) has been trying to diversify itself away from risky mining jurisdictions. It unbundled its labor-intensive South African operations in Sibanye Gold and at the same time purchased assets from Barrick Gold (ABX) in Australia. With this, the company’s geopolitical risk has reduced greatly with ~45% of its production coming from Australia and ~10% from South Africa.

The SPDR Gold Trust (GLD) mirrors gold prices in the market. Eldorado and AngloGold Ashanti account for 8.2% of GDX’s holdings.

Next we’ll look at gold miners’ production outlook.